Question: Question 2 ( 2 5 marks ) On January 1 , 2 0 1 4 , Prince Corporation acquired 7 0 % of the 1

Question marks

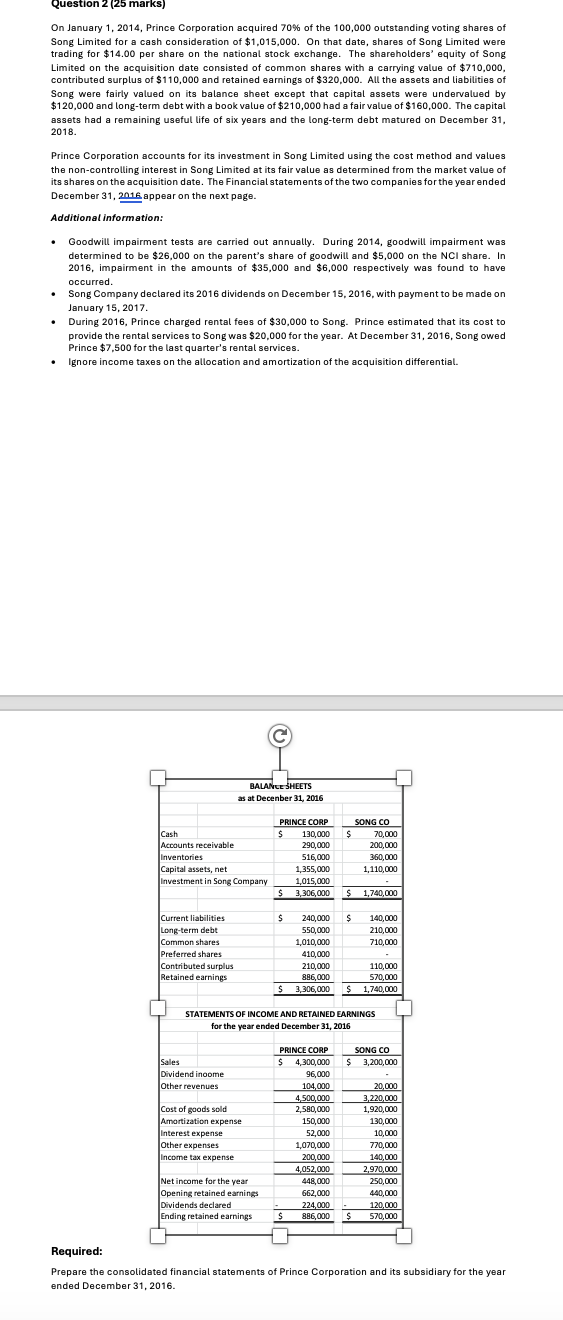

On January Prince Corporation acquired of the outstanding voting shares of

Song Limited for a cash consideration of $ On that date, shares of Song Limited were

trading for $ per share on the national stock exchange. The shareholders' equity of Song

Limited on the acquisition date consisted of common shares with a carrying value of $

contributed surplus of $ and retained earnings of $ All the assets and liabilities of

Song were fairly valued on its balance sheet except that capital assets were undervalued by

$ and longterm debt with a book value of $ had a fair value of $ The capital

assets had a remaining useful life of six years and the longterm debt matured on December

Prince Corporation accounts for its investment in Song Limited using the cost method and values

the noncontrolling interest in Song Limited at its fair value as determined from the market value of

its shares on the acquisition date. The Financial statements of the two companies for the year ended

December appear on the next page.

Additional information:

Goodwill impairment tests are carried out annually. During goodwill impairment was

determined to be $ on the parent's share of goodwill and $ on the NCI share. In

impairment in the amounts of $ and $ respectively was found to have

occurred.

Song Company declared its dividends on December with payment to be made on

January

During Prince charged rental fees of $ to Song. Prince estimated that its cost to

provide the rental services to Song was $ for the year. At December Song owed

Prince $ for the last quarter's rental services.

Ignore income taxes on the allocation and amortization of the acquisition differential.

Required:

Prepare the consolidated financial statements of Prince Corporation and its subsidiary for the year

ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock