Question: QUESTION 2 ( 2 5 Marks ) Woolies Limited, a South African - based muffin manufacturing company, intends to expand its output capacity in order

QUESTION

Marks

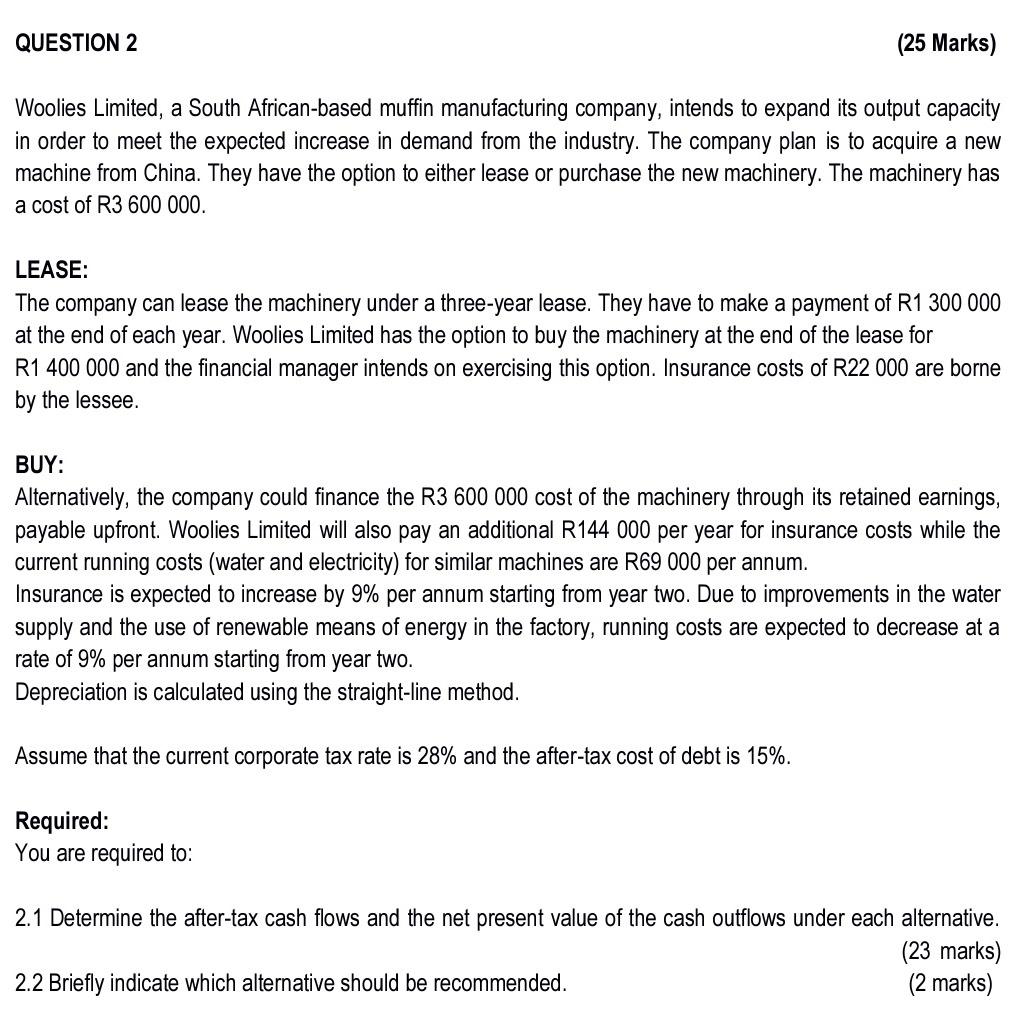

Woolies Limited, a South Africanbased muffin manufacturing company, intends to expand its output capacity in order to meet the expected increase in demand from the industry. The company plan is to acquire a new machine from China. They have the option to either lease or purchase the new machinery. The machinery has a cost of R

LEASE:

The company can lease the machinery under a threeyear lease. They have to make a payment of R at the end of each year. Woolies Limited has the option to buy the machinery at the end of the lease for R and the financial manager intends on exercising this option. Insurance costs of R are borne by the lessee.

BUY:

Alternatively, the company could finance the R cost of the machinery through its retained earnings, payable upfront. Woolies Limited will also pay an additional R per year for insurance costs while the current running costs water and electricity for similar machines are R per annum.

Insurance is expected to increase by per annum starting from year two. Due to improvements in the water supply and the use of renewable means of energy in the factory, running costs are expected to decrease at a rate of per annum starting from year two.

Depreciation is calculated using the straightline method.

Assume that the current corporate tax rate is and the aftertax cost of debt is

Required:

You are required to:

Determine the aftertax cash flows and the net present value of the cash outflows under each alternative.

marks

Briefly indicate which alternative should be recommended.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock