Question: QUESTION 2 ( 2 5 MARKS ) You are required to assist management with the income tax disclosures in the financial report. The accountant prepared

QUESTION

MARKS

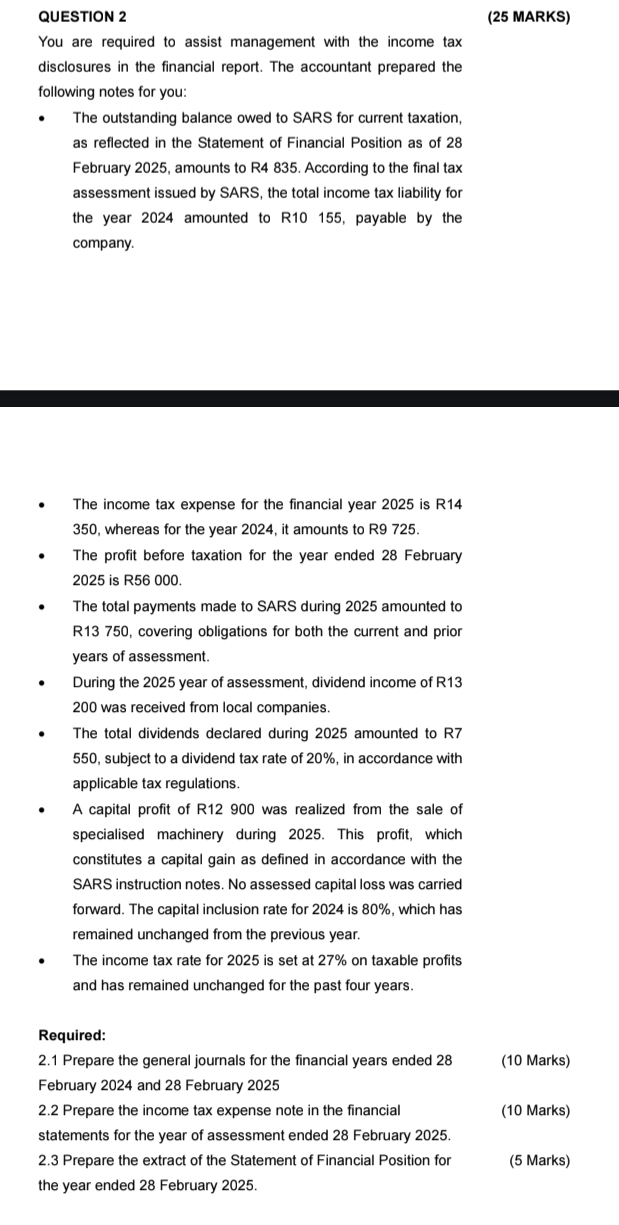

You are required to assist management with the income tax disclosures in the financial report. The accountant prepared the following notes for you:

The outstanding balance owed to SARS for current taxation, as reflected in the Statement of Financial Position as of February amounts to R According to the final tax assessment issued by SARS, the total income tax liability for the year amounted to R payable by the company.

The income tax expense for the financial year is R whereas for the year it amounts to R

The profit before taxation for the year ended February is R

The total payments made to SARS during amounted to R covering obligations for both the current and prior years of assessment.

During the year of assessment, dividend income of R was received from local companies.

The total dividends declared during amounted to R subject to a dividend tax rate of in accordance with applicable tax regulations.

A capital profit of R was realized from the sale of specialised machinery during This profit, which constitutes a capital gain as defined in accordance with the SARS instruction notes. No assessed capital loss was carried forward. The capital inclusion rate for is which has remained unchanged from the previous year.

The income tax rate for is set at on taxable profits and has remained unchanged for the past four years.

Required:

Prepare the general journals for the financial years ended

Marks

February and February

Prepare the income tax expense note in the financial

Marks statements for the year of assessment ended February Prepare the extract of the Statement of Financial Position for

Marks

the year ended February

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock