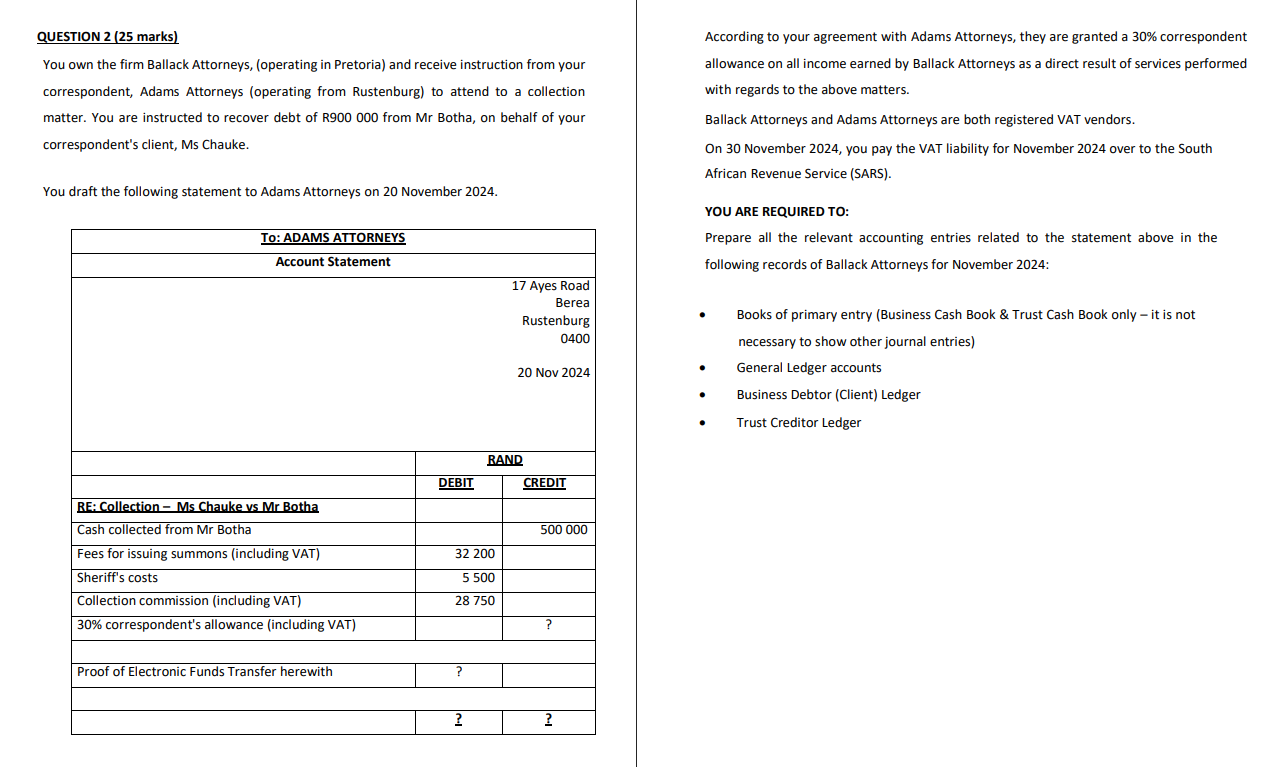

Question: QUESTION 2 ( 2 5 marks ) You own the firm Ballack Attorneys, ( operating in Pretoria ) and receive instruction from your correspondent, Adams

QUESTION marks You own the firm Ballack Attorneys, operating in Pretoria and receive instruction from your correspondent, Adams Attorneys operating from Rustenburg to attend to a collection matter. You are instructed to recover debt of R from Mr Botha, on behalf of your correspondent's client, Ms Chauke. You draft the following statement to Adams Attorneys on November Ayes Road Berea Rustenburg According to your agreement with Adams Attorneys, they are granted a correspondent allowance on all income earned by Ballack Attorneys as a direct result of services performed with regards to the above matters. Ballack Attorneys and Adams Attorneys are both registered VAT vendors. On November you pay the VAT liability for November over to the South African Revenue Service SARS YOU ARE REQUIRED TO: Prepare all the relevant accounting entries related to the statement above in the following records of Ballack Attorneys for November : Books of primary entry Business Cash Book & Trust Cash Book only it is not necessary to show other journal entries General Ledger accounts Business Debtor Client Ledger Trust Creditor Ledger.In order to obtain a mark for a transaction "leg" debitcredit entry a l l the following should be in place: the accounting entry has to be appear under the correct account name; the accounting entry has to be correctly allocated to the debit or credit side. the contraaccount on the description has to be correct; and the Rand amount of the entry should be correct. If any of these aspects is incorrect,no mark will be awarded for the specific answer provided. Where specifically indicated that Value Added Tax VAT is applicable, a VAT rate of should be used for calculations

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock