Question: Question 2 ( 2 5 points ) A small pension fund has the following liabilities ( in million dollars ) : table [ [

Question points

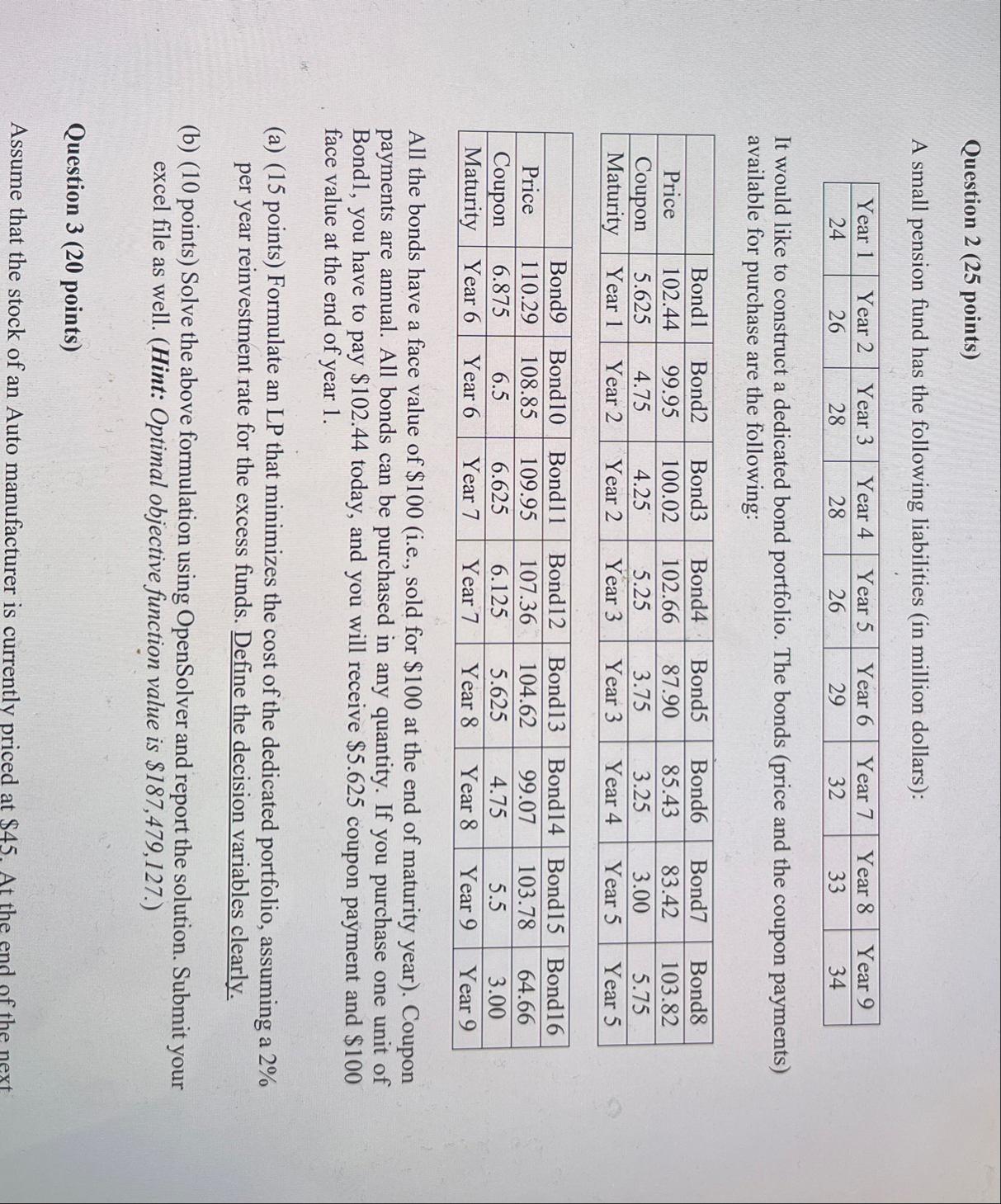

A small pension fund has the following liabilities in million dollars:

tableYear Year Year Year Year Year Year Year Year

It would like to construct a dedicated bond portfolio. The bonds price and the coupon payments available for purchase are the following:

tableBondBondBondBondBondBondBondBondPriceCouponMaturityYear Year Year Year Year Year Year Year

tableBondBondBondBondBondBondBondBondPriceCouponMaturityYear Year Year Year Year Year Year Year

All the bonds have a face value of $ie sold for $ at the end of maturity year Coupon payments are annual. All bonds can be purchased in any quantity. If you purchase one unit of Bond you have to pay $ today, and you will receive $ coupon payment and $ face value at the end of year

a points Formulate an LP that minimizes the cost of the dedicated portfolio, assuming a per year reinvestment rate for the excess funds. Define the decision variables clearly.

b points Solve the above formulation using OpenSolver and report the solution. Submit your excel file as well. Hint: Optimal objective function value is $

Question points

Assume that the stock of an Auto manufacturer is currently priced at $ At the end of the next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock