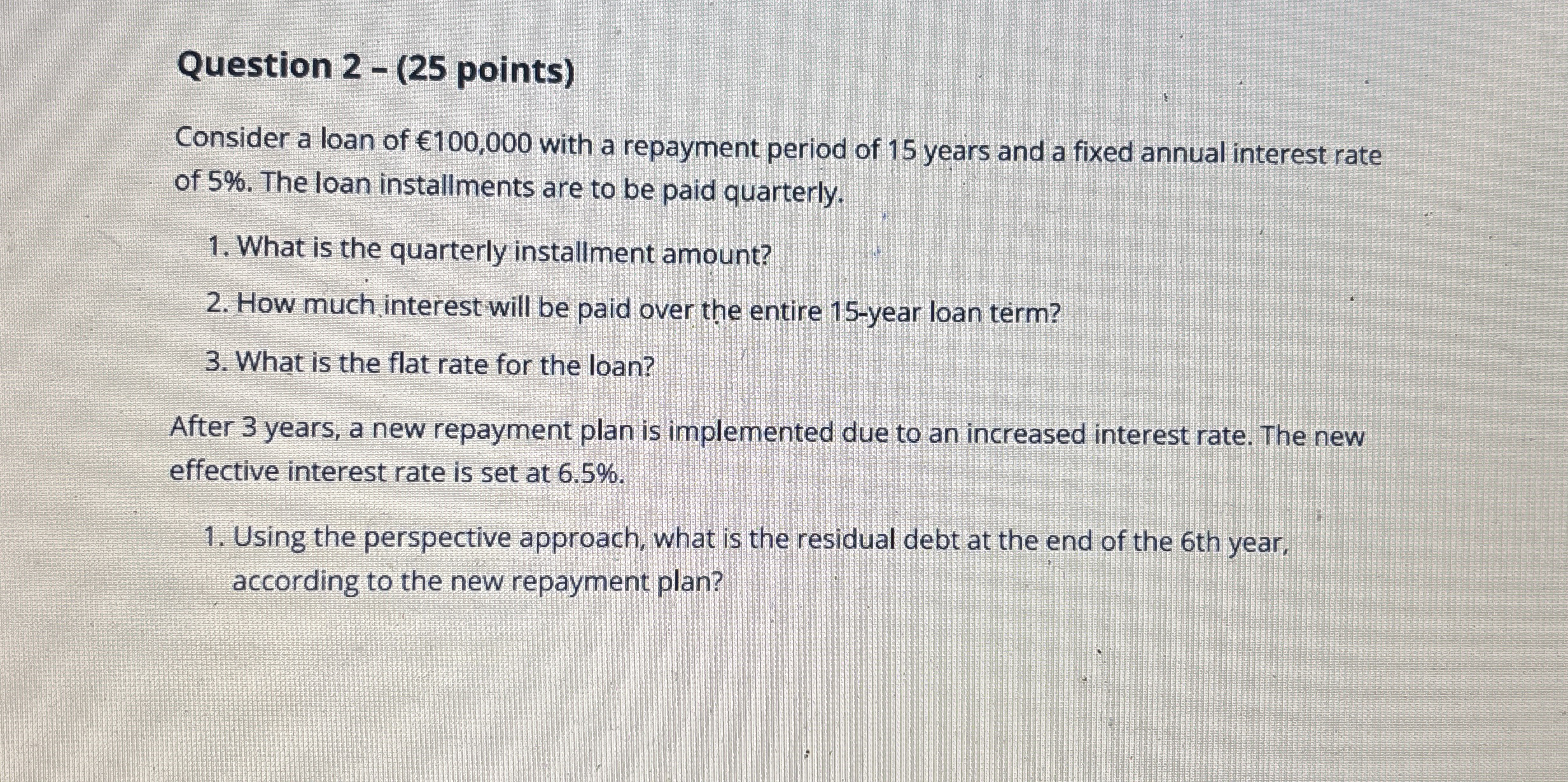

Question: Question 2 - ( 2 5 points ) Consider a loan of 1 0 0 , 0 0 0 with a repayment period of 1

Question points

Consider a loan of with a repayment period of years and a fixed annual interest rate of The loan installments are to be paid quarterly.

What is the quarterly installment amount?

How much interest will be paid over the entire year loan term?

What is the flat rate for the loan?

After years, a new repayment plan is implemented due to an increased interest rate. The new effective interest rate is set at

Using the perspective approach, what is the residual debt at the end of the th year, according to the new repayment plan?

A real estate firm is evaluating the feasibility of investing in a new property development project. The company has the opportunity to purchase the land for on January The Overall construction and development expenses are projected to be which will be paid in eight equal monthly installments in advance, starting on June

The construction phase will end on September and rental income is expected to begin flowing in from December with revenue being recelved every quarter in advance. The projected remal earnings amount to per quarter. Meanwhile, operational costs, including property management and upkeep, are anticipated to be per quarter, payable In adrance starting from December

It is assumed that all costs and revenues will come to an end by September

Calculate the net present valye and accumblated value of the project, assuming a discount rate of

Using Excel or simulate scenarios of interest rates uniformly distributed between and and calculate the expected net presens value and accumulated value of the project. Additionally, determine the probability that the net present watue exiceeds the expected values computed in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock