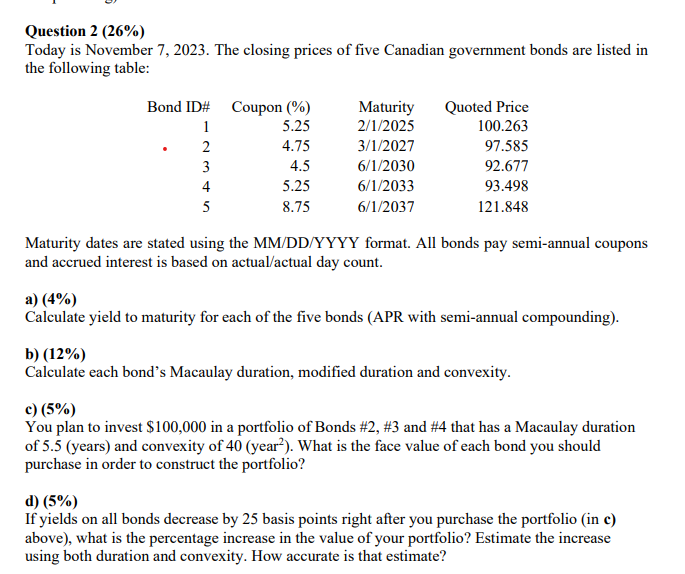

Question: Question 2 ( 2 6 % ) Today is November 7 , 2 0 2 3 . The closing prices of five Canadian government bonds

Question

Today is November The closing prices of five Canadian government bonds are listed in

the following table:

Maturity dates are stated using the MMDDYYYY format. All bonds pay semiannual coupons

and accrued interest is based on actualactual day count.

a

Calculate yield to maturity for each of the five bonds APR with semiannual compounding

b

Calculate each bond's Macaulay duration, modified duration and convexity.

c

You plan to invest $ in a portfolio of Bonds # # and # that has a Macaulay duration

of years and convexity of What is the face value of each bond you should

purchase in order to construct the portfolio?

d

If yields on all bonds decrease by basis points right after you purchase the portfolio in c

above what is the percentage increase in the value of your portfolio? Estimate the increase

using both duration and convexity. How accurate is that estimate?Question

Today is November The closing prices of five Canadian government bonds are listed in

the following table:

Maturity dates are stated using the MMDDYYYY format. All bonds pay semiannual coupons

and accrued interest is based on actualactual day count.

a

Calculate yield to maturity for each of the five bonds APR with semiannual compounding

b

Calculate each bond's Macaulay duration, modified duration and convexity.

c

You plan to invest $ in a portfolio of Bonds # # and # that has a Macaulay duration

of years and convexity of What is the face value of each bond you should

purchase in order to construct the portfolio?

d

If yields on all bonds decrease by basis points right after you purchase the portfolio in c

above what is the percentage increase in the value of your portfolio? Estimate the increase

using both duration and convexity. How accurate is that estimate?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock