Question: QUESTION 2 ( 2 7 marks ) Peters Ltd ( Peters ) is a large stationery manufacturer and retailer. Peters has a financial

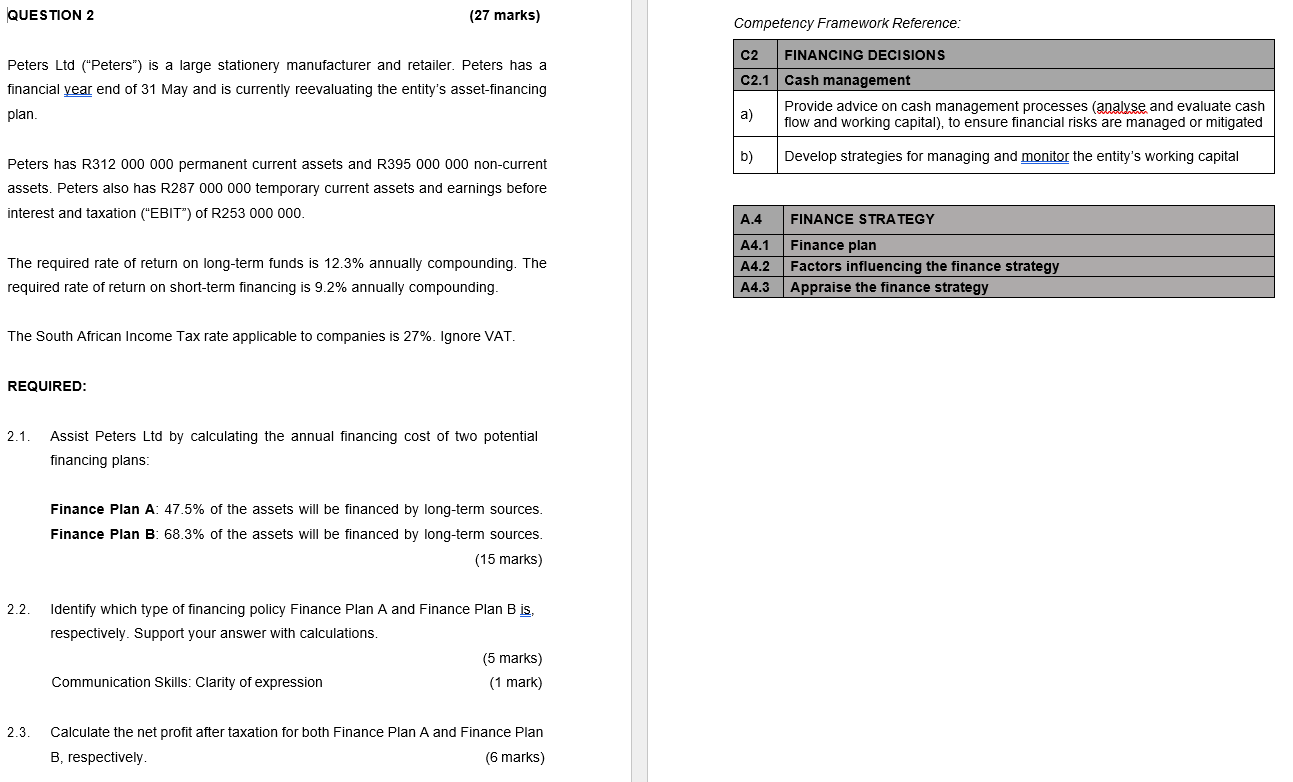

QUESTION marks Peters Ltd Peters is a large stationery manufacturer and retailer. Peters has a financial year end of May and is currently reevaluating the entity's assetfinancing plan. Peters has R permanent current assets and R noncurrent assets. Peters also has R temporary current assets and earnings before interest and taxation EBIT of R The required rate of return on longterm funds is annually compounding. The required rate of return on shortterm financing is annually compounding. The South African Income Tax rate applicable to companies is Ignore VAT. REQUIRED: Assist Peters Ltd by calculating the annual financing cost of two potential financing plans: Finance Plan A: of the assets will be financed by longterm sources. Finance Plan B: of the assets will be financed by longterm sources. marks Identify which type of financing policy Finance Plan A and Finance Plan B is respectively. Support your answer with calculations. Communication Skills: Clarity of expression Calculate the net profit after taxation for both Finance Plan A and Finance Plan B respectively. marks Competency Framework Reference:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock