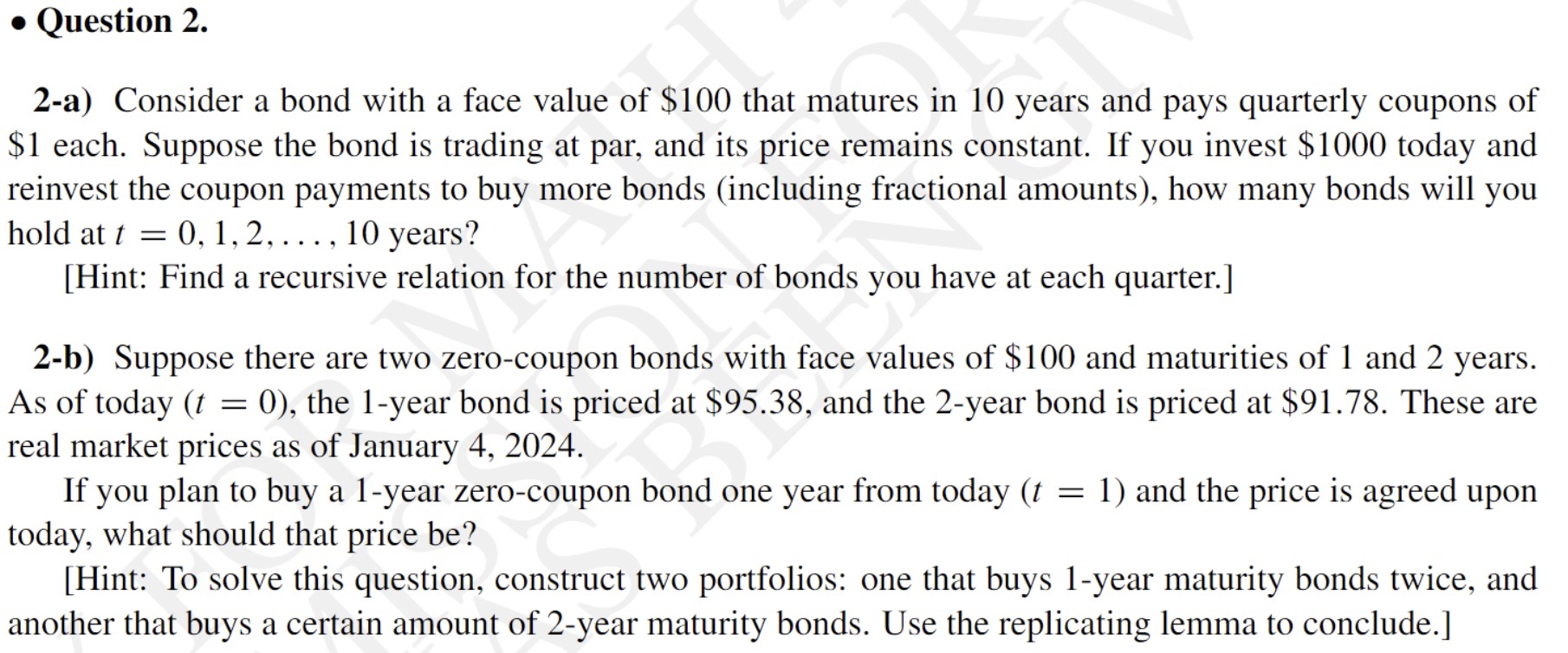

Question: Question 2 . 2 - a ) Consider a bond with a face value of $ 1 0 0 that matures in 1 0 years

Question

a Consider a bond with a face value of $ that matures in years and pays quarterly coupons of

$ each. Suppose the bond is trading at par, and its price remains constant. If you invest $ today and

reinvest the coupon payments to buy more bonds including fractional amounts how many bonds will you

hold at dots, years?

Hint: Find a recursive relation for the number of bonds you have at each quarter.

b Suppose there are two zerocoupon bonds with face values of $ and maturities of and years.

As of today the year bond is priced at $ and the year bond is priced at $ These are

real market prices as of January

If you plan to buy a year zerocoupon bond one year from today and the price is agreed upon

today, what should that price be

Hint: To solve this question, construct two portfolios: one that buys year maturity bonds twice, and

another that buys a certain amount of year maturity bonds. Use the replicating lemma to conclude.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock