Question: Question 2 ( 2 points ) An employee was granted the right to use a company car at a cost of R 4 5 0

Question points

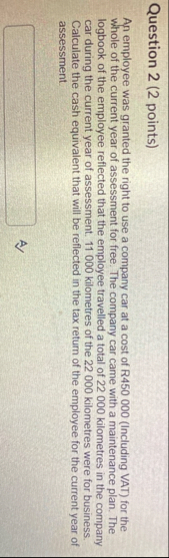

An employee was granted the right to use a company car at a cost of RIncluding VAT for the whole of the current year of assessment for free. The company car came with a maintenance plan. The logbook of the employee reflected that the employee travelled a total of kilometres in the company car during the current year of assessment. kilometres of the kilometres were for business. Calculate the cash equivalent that will be reflected in the tax return of the employee for the current year of assessment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock