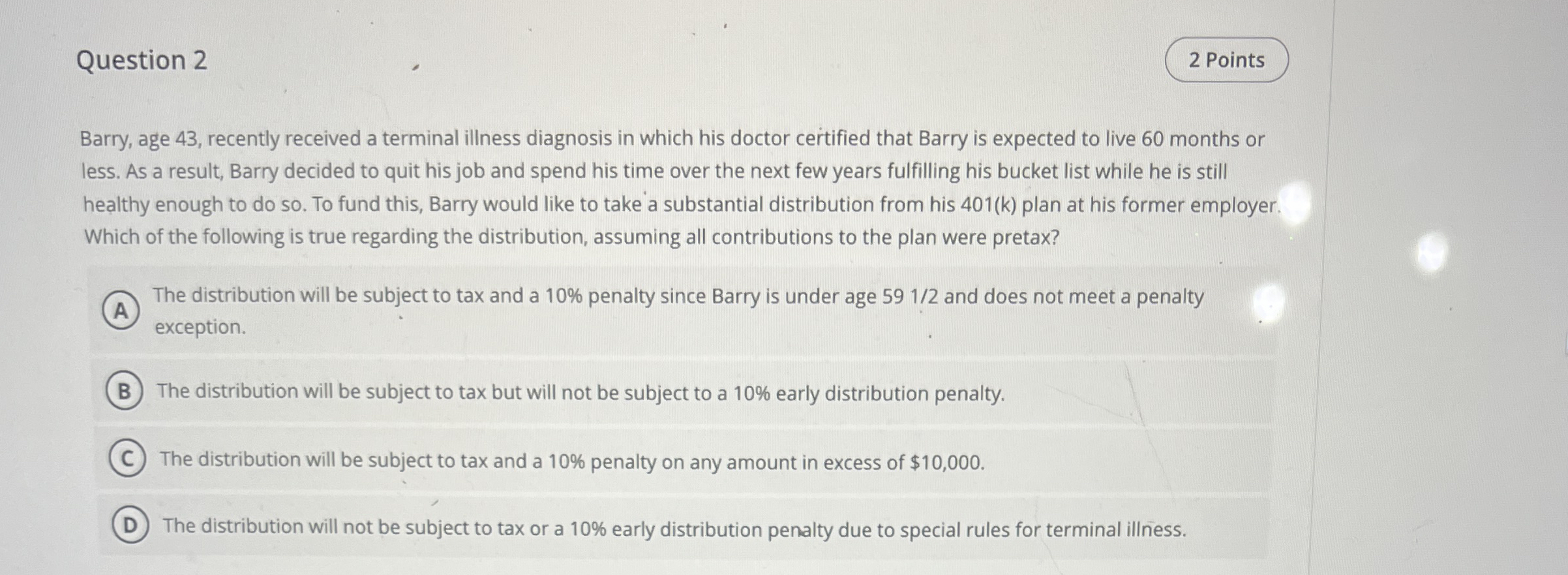

Question: Question 2 2 Points Barry, age 4 3 , recently received a terminal illness diagnosis in which his doctor certified that Barry is expected to

Question

Points

Barry, age recently received a terminal illness diagnosis in which his doctor certified that Barry is expected to live months or less. As a result, Barry decided to quit his job and spend his time over the next few years fulfilling his bucket list while he is still healthy enough to do so To fund this, Barry would like to take a substantial distribution from his k plan at his former employer. Which of the following is true regarding the distribution, assuming all contributions to the plan were pretax?

The distribution will be subject to tax and a penalty since Barry is under age and does not meet a penalty exception.

The distribution will be subject to tax but will not be subject to a early distribution penalty.

The distribution will be subject to tax and a penalty on any amount in excess of $

The distribution will not be subject to tax or a early distribution penalty due to special rules for terminal illness.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock