Question: Question 2 (2 points) Big Plane Co. had the following transactions in October, 2021: Sold parts to Jet Inc. for $120,000, terms FOB shipping point.

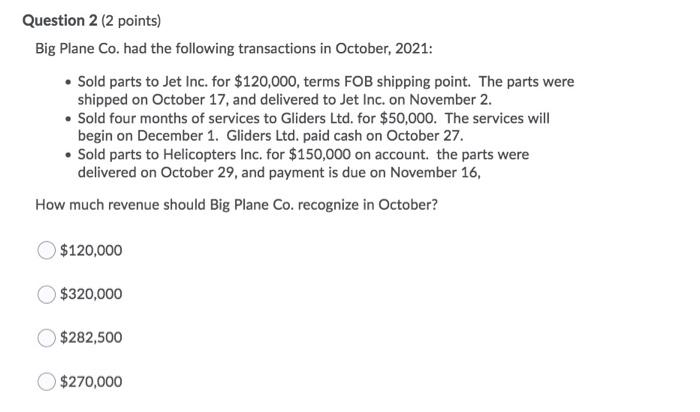

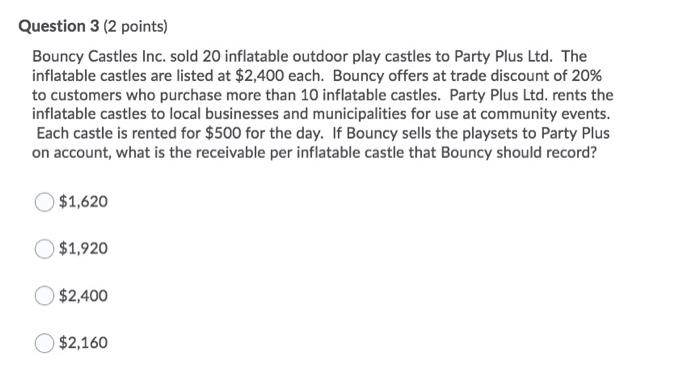

Question 2 (2 points) Big Plane Co. had the following transactions in October, 2021: Sold parts to Jet Inc. for $120,000, terms FOB shipping point. The parts were shipped on October 17, and delivered to Jet Inc. on November 2. Sold four months of services to Gliders Ltd. for $50,000. The services will begin on December 1. Gliders Ltd. paid cash on October 27. Sold parts to Helicopters Inc. for $150,000 on account the parts were delivered on October 29, and payment is due on November 16, How much revenue should Big Plane Co. recognize in October? $120,000 $320,000 $282,500 $270,000 Question 3 (2 points) Bouncy Castles Inc. sold 20 inflatable outdoor play castles to Party Plus Ltd. The inflatable castles are listed at $2,400 each. Bouncy offers at trade discount of 20% to customers who purchase more than 10 inflatable castles. Party Plus Ltd. rents the inflatable castles to local businesses and municipalities for use at community events. Each castle is rented for $500 for the day. If Bouncy sells the playsets to Party Plus on account, what is the receivable per inflatable castle that Bouncy should record? $1,620 $1,920 $2,400 $2,160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts