Question: Question 2 (2 points) Sam is considering a new business venture operating a carrier business. He can buy a van for $60,000 including taxes. He

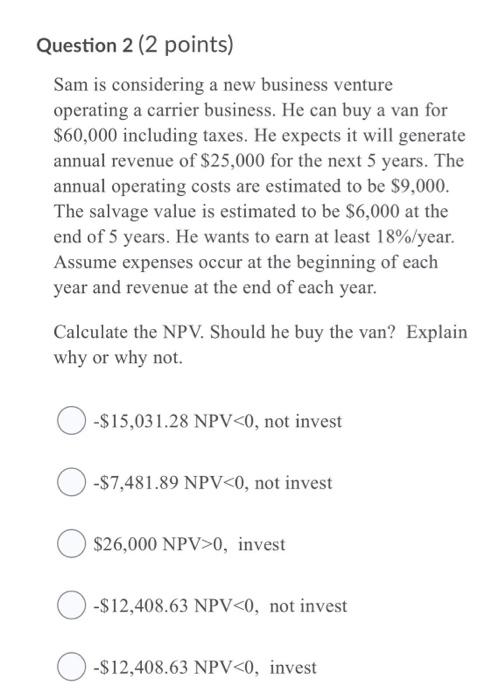

Question 2 (2 points) Sam is considering a new business venture operating a carrier business. He can buy a van for $60,000 including taxes. He expects it will generate annual revenue of $25,000 for the next 5 years. The annual operating costs are estimated to be $9,000. The salvage value is estimated to be $6,000 at the end of 5 years. He wants to earn at least 18%/year. Assume expenses occur at the beginning of each year and revenue at the end of each year. Calculate the NPV. Should he buy the van? Explain why or why not 0-$15,031.28 NPV0, invest -$12,408.63 NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts