Question: Question 2 (2 points) Saved Listen Groh and Jackson are partners. Groh's capital balance is $64,000, and Jackson's is $61,000. Groh and Jackson agreed to

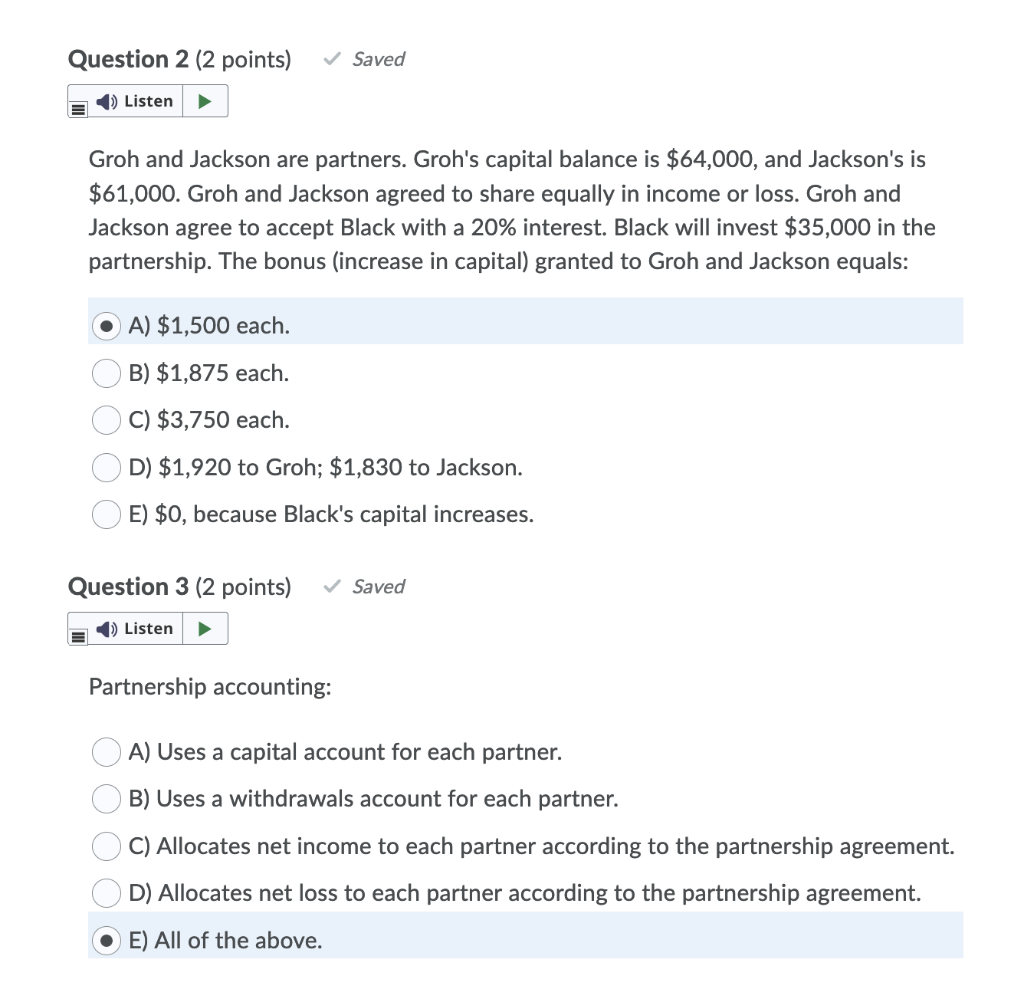

Question 2 (2 points) Saved Listen Groh and Jackson are partners. Groh's capital balance is $64,000, and Jackson's is $61,000. Groh and Jackson agreed to share equally in income or loss. Groh and Jackson agree to accept Black with a 20% interest. Black will invest $35,000 in the partnership. The bonus (increase in capital) granted to Groh and Jackson equals: A) $1,500 each. B) $1,875 each. C) $3,750 each. D) $1,920 to Groh; $1,830 to Jackson. E) $0, because Black's capital increases. Question 3 (2 points) Saved Listen Partnership accounting: A) Uses a capital account for each partner. B) Uses a withdrawals account for each partner. C) Allocates net income to each partner according to the partnership agreement. D) Allocates net loss to each partner according to the partnership agreement. E) All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts