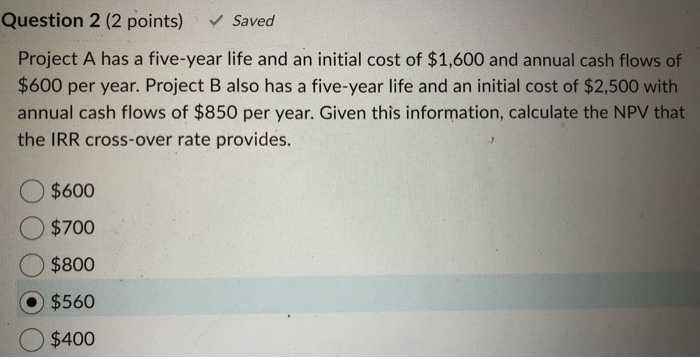

Question: Question 2 (2 points) Saved Project A has a five-year life and an initial cost of $1,600 and annual cash flows of $600 per year.

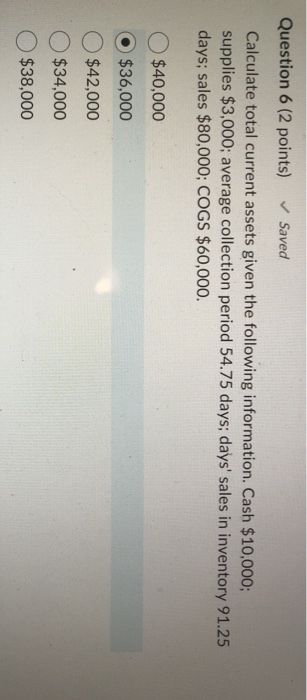

Question 2 (2 points) Saved Project A has a five-year life and an initial cost of $1,600 and annual cash flows of $600 per year. Project B also has a five-year life and an initial cost of $2,500 with annual cash flows of $850 per year. Given this information, calculate the NPV that the IRR cross-over rate provides. $600 $700 $800 $560 $400 Question 6 (2 points) Saved Calculate total current assets given the following information. Cash $10,000; supplies $3,000; average collection period 54.75 days; days' sales in inventory 91.25 days, sales $80,000; COGS $60,000. $40,000 $36,000 $42,000 $34,000 $38,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts