Question: Question 2 2 pts 1. Physicians Ltd. received a highly specialized piece of medical equipment from a nearby hospital. If the equipment was purchased new,

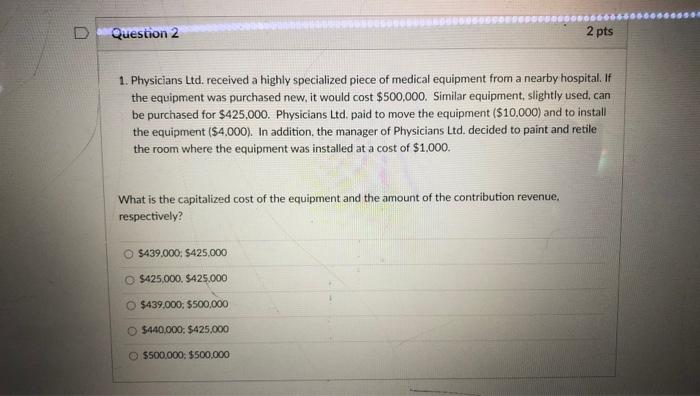

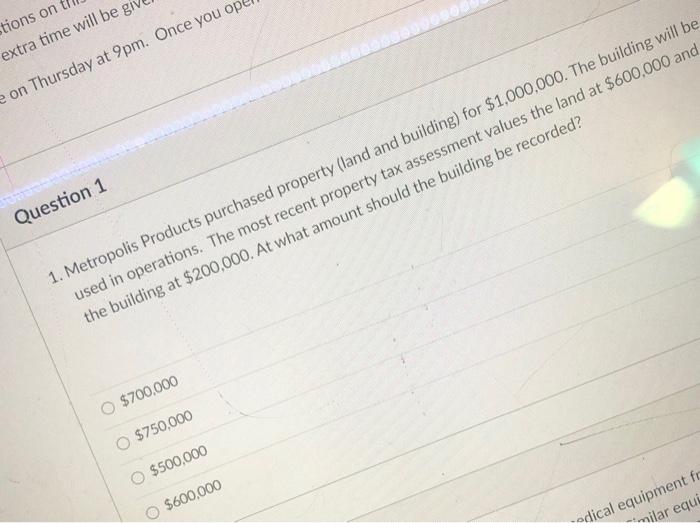

Question 2 2 pts 1. Physicians Ltd. received a highly specialized piece of medical equipment from a nearby hospital. If the equipment was purchased new, it would cost $500,000. Similar equipment, slightly used, can be purchased for $425,000. Physicians Ltd, paid to move the equipment ($10.000) and to install the equipment ($4.000). In addition, the manager of Physicians Ltd. decided to paint and retile the room where the equipment was installed at a cost of $1,000. What is the capitalized cost of the equipment and the amount of the contribution revenue, respectively? $439.000: $425.000 $425,000. $425,000 $439,000 $500,000 O $440,000: $425,000 O $500.000: $500.000 tions on extra time will be gi e on Thursday at 9pm. Once you op Question 1 1. Metropolis Products purchased property (land and building) for $1,000,000. The building will be used in operations. The most recent property tax assessment values the land at $600,000 and the building at $200,000. At what amount should the building be recorded? O $700,000 O $750,000 $500,000 $600,000 edical equipment for milar equi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts