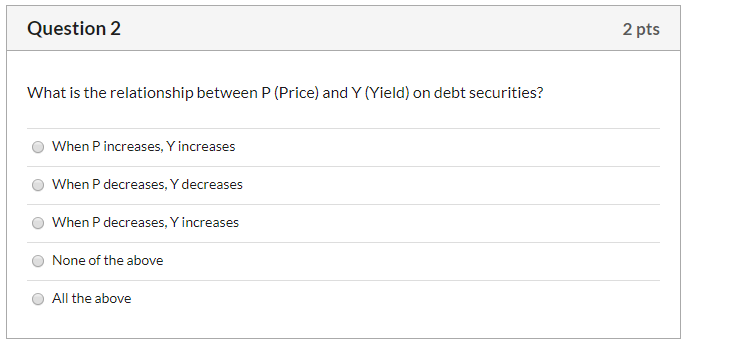

Question: Question 2 2 pts What is the relationship between P (Price) and Y (Yield) on debt securities? When Pincreases, Y increases When P decreases, Y

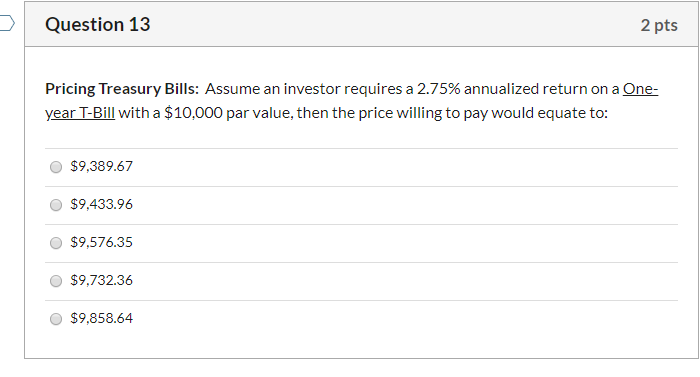

Question 2 2 pts What is the relationship between P (Price) and Y (Yield) on debt securities? When Pincreases, Y increases When P decreases, Y decreases When P decreases, Y increases None of the above All the above Question 13 2 pts Pricing Treasury Bills: Assume an investor requires a 2.75% annualized return on a One- year T-Bill with a $10,000 par value, then the price willing to pay would equate to: $9,389.67 $9,433.96 $9,576.35 $9,732.36 $9,858.64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts