Question: Question 2 2 Questions 2 1 - 2 2 relate to the comparative balance sheets, income statement and supplementary notes of the Initech Company shown

Question

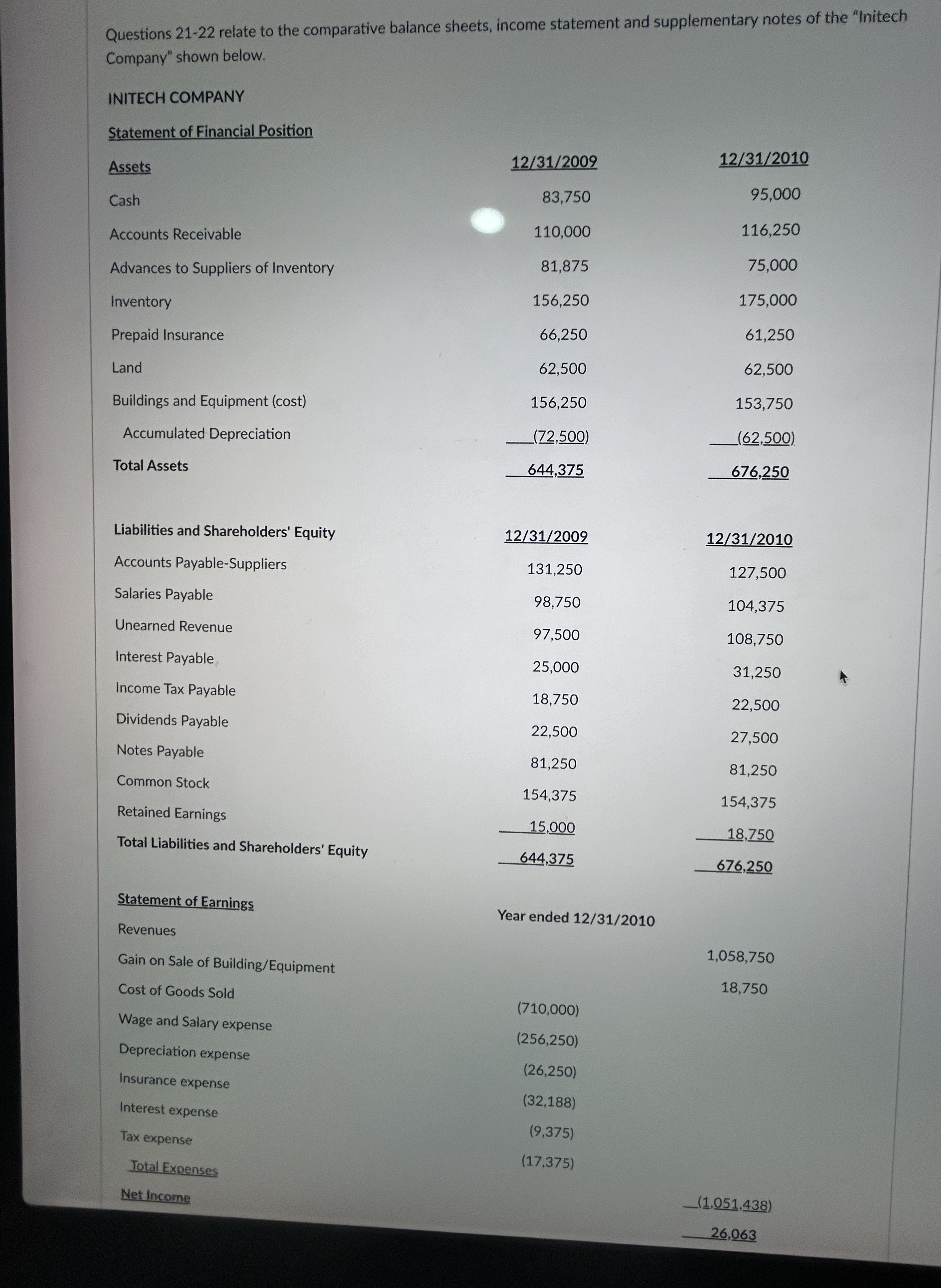

Questions relate to the comparative balance sheets, income statement and supplementary notes of the "Initech

Company" shown below.

INITECH COMPANY

Statement of Financial Position

Supplementary notes:

In no common stock was repurchased or retired and no notes payable were issued.

Buildings & Equipment with a net book value of $cost less accumulated depreciation was sold in

Inventories are stated at the lower of cost or market. Cost is principally determined using the lastin firstout LIFO

method. The value of inventories on the LIFO basis represented about of total inventories at December

and at December If the FIFO firstin firstout method has been in use, inventories would have

been $ and $ higher than reported at December and respectively.

REQUIRED: How much cash was received from customers during Show all work to receive cred

Questions relate to the comparative balance sheets, income statement and supplementary notes of the "Initech

Company" shown below.

INITECH COMPANY

Statement of Financial Position

Statement of Earnings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock