Question: QUESTION 2 2 Which statement is NOT correct about the FLSA? Employers whose employees receive more than $ 3 0 in tips may consider tips

QUESTION

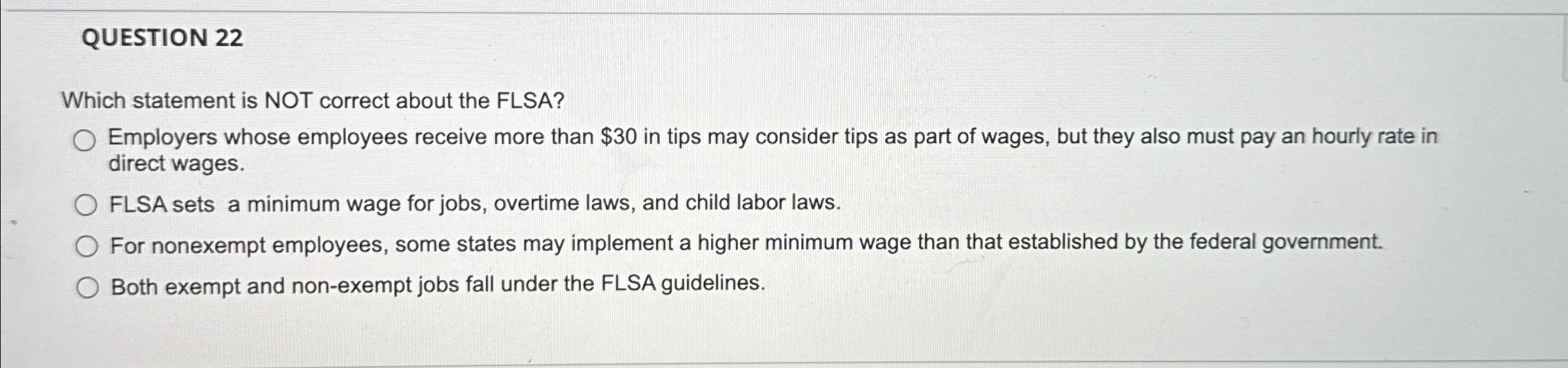

Which statement is NOT correct about the FLSA?

Employers whose employees receive more than $ in tips may consider tips as part of wages, but they also must pay an hourly rate in direct wages.

FLSA sets a minimum wage for jobs, overtime laws, and child labor laws.

For nonexempt employees, some states may implement a higher minimum wage than that established by the federal government.

Both exempt and nonexempt jobs fall under the FLSA guidelines.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock