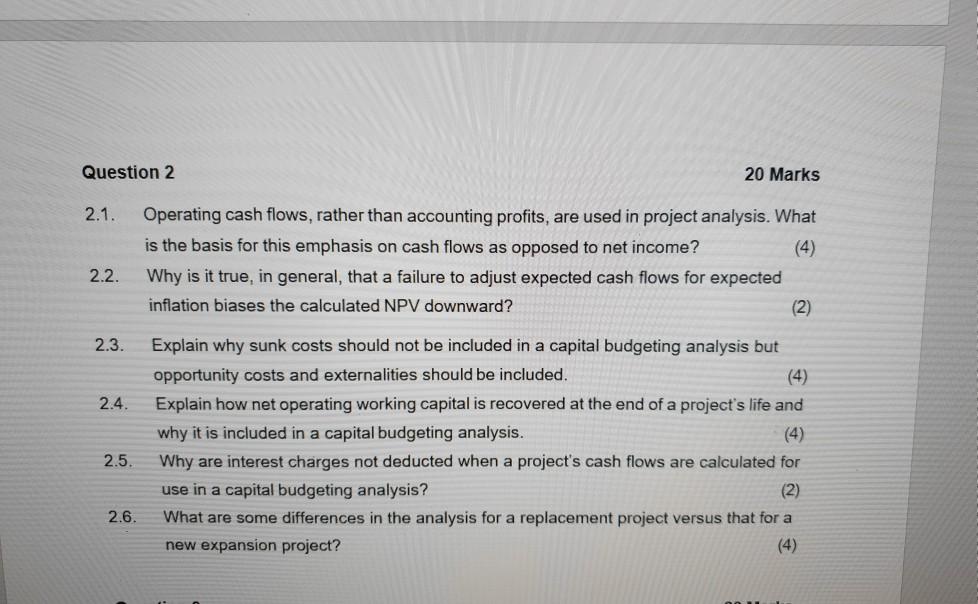

Question: Question 2 20 Marks 2.1. Operating cash flows, rather than accounting profits, are used in project analysis. What is the basis for this emphasis on

Question 2 20 Marks 2.1. Operating cash flows, rather than accounting profits, are used in project analysis. What is the basis for this emphasis on cash flows as opposed to net income? (4) Why is it true, in general, that a failure to adjust expected cash flows for expected inflation biases the calculated NPV downward? (2) 2.2. 2.3. 2.4. Explain why sunk costs should not be included in a capital budgeting analysis but opportunity costs and externalities should be included. Explain how net operating working capital is recovered at the end of a project's life and why it is included in a capital budgeting analysis. (4) Why are interest charges not deducted when a project's cash flows are calculated for use in a capital budgeting analysis? (2) What are some differences in the analysis for a replacement project versus that for a new expansion project? (4) 2.5. 2.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts