Question: Question 2 (20 Marks) a) A bond with a coupon rate of 7% makes semi-annual coupon payments on January 15 and July 15 of each

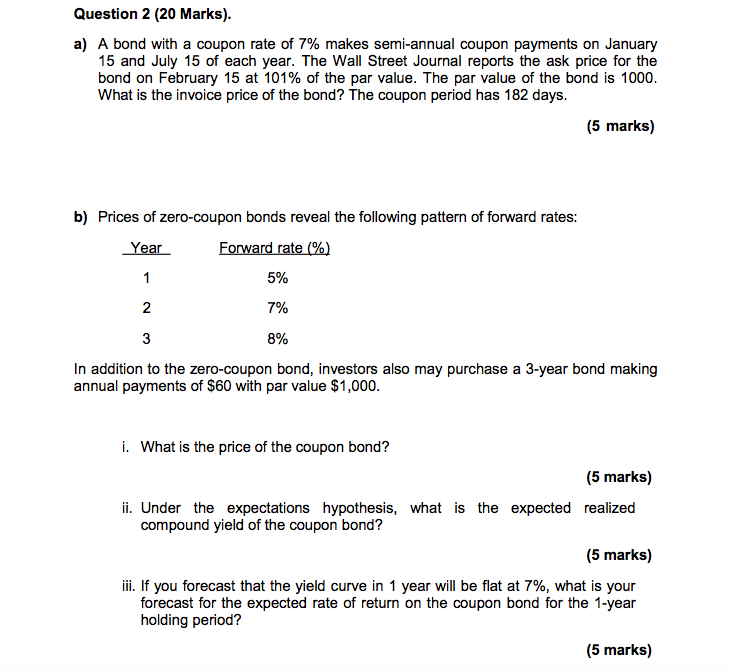

Question 2 (20 Marks) a) A bond with a coupon rate of 7% makes semi-annual coupon payments on January 15 and July 15 of each year. The Wall Street Journal reports the ask price for the bond on February 15 at 101% of the par value. The par value of the bond is 1000 What is the invoice price of the bond? The coupon period has 182 days (5 marks) b) Prices of zero-coupon bonds reveal the following pattern of forward rates: 5% 7% 5% 2 In addition to the zero-coupon bond, investors also may purchase a 3-year bond making annual payments of $60 with par value $1,000 i. What is the price of the coupon bond? (5 marks) ii. Under the expectations hypothesis, what is the expected realized compound yield of the coupon bond? (5 marks) iii. If you forecast that the yield curve in 1 year will be flat at 7%, what is your forecast for the expected rate of return on the coupon bond for the 1-year holding period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts