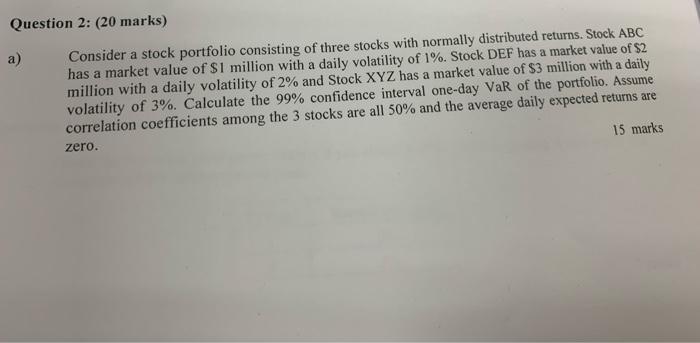

Question: Question 2: (20 marks) a) Consider a stock portfolio consisting of three stocks with normally distributed returns. Stock ABC has a market value of $1

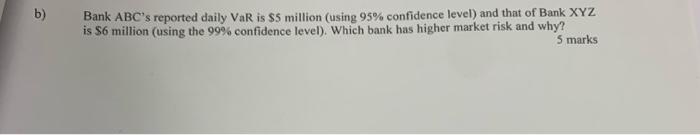

Question 2: (20 marks) a) Consider a stock portfolio consisting of three stocks with normally distributed returns. Stock ABC has a market value of $1 million with a daily volatility of 1%. Stock DEF has a market value of $2 million with a daily volatility of 2% and Stock XYZ has a market value of $3 million with a daily volatility of 3%. Calculate the 99% confidence interval one-day VaR of the portfolio. Assume correlation coefficients among the 3 stocks are all 50% and the average daily expected returns are 15 marks zero. b) Bank ABC's reported daily VaR is $5 million (using 95% confidence level) and that of Bank XYZ is $6 million (using the 99% confidence level). Which bank has higher market risk and why? 5 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts