Question: Question 2: (20 marks) a. How could the AOU use the concepts in the balanced scorecard? List two possible performance measures that would be relevant

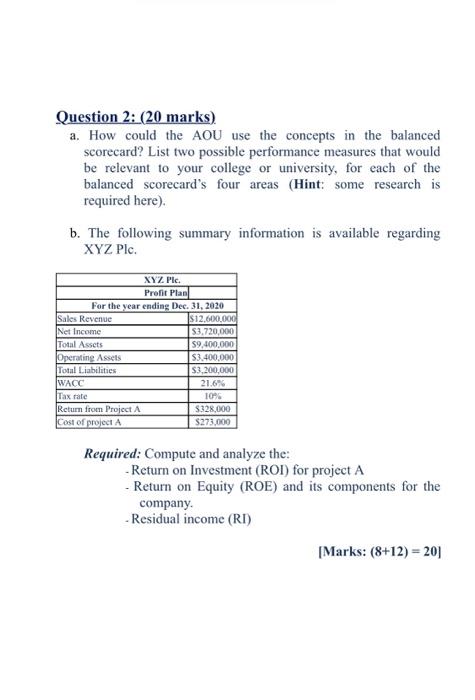

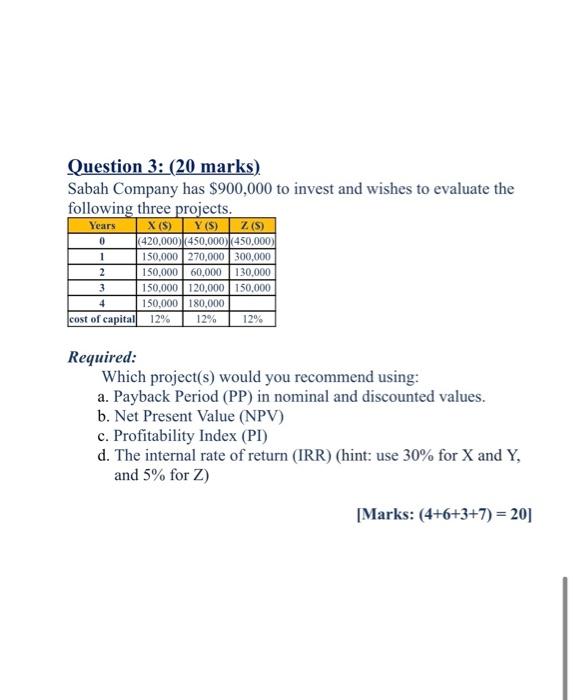

Question 2: (20 marks) a. How could the AOU use the concepts in the balanced scorecard? List two possible performance measures that would be relevant to your college or university, for each of the balanced Scorecard's four areas (Hint: some research is required here). b. The following summary information is available regarding XYZ Plc. XYZ Plc. Profit Plan For the year ending Dec. 31, 2020 Sales Revenue $12.600,000 Net Income 53.720,000 Total Assets S9,400,000 Operating Assets $3.400.000 Total Liabilities $3,200,000 WACC 21.66 Tax rate 1096 Return from Project A 328,000 Cost of project A $273,000 Required: Compute and analyze the: - Return on Investment (ROI) for project A - Return on Equity (ROE) and its components for the company. Residual income (RI) [Marks: (8+12) = 20 Question 3: (20 marks) Sabah Company has $900,000 to invest and wishes to evaluate the following three projects. Years X (S) Y(S) Z(S) 420.000 450,000 450.000 150,000 270,000 300,000 2 150,000 60,000 130,000 3 150,000 120,000 150,000 4 150,000 180,000 cost of capital 12% 12% 12% 0 1 Required: Which project(s) would you recommend using: a. Payback Period (PP) in nominal and discounted values. b. Net Present Value (NPV) c. Profitability Index (PI) d. The internal rate of return (IRR) (hint: use 30% for X and Y, and 5% for Z) Marks: (4+6+3+7) = 20) Question 2: (20 marks) a. How could the AOU use the concepts in the balanced scorecard? List two possible performance measures that would be relevant to your college or university, for each of the balanced Scorecard's four areas (Hint: some research is required here). b. The following summary information is available regarding XYZ Plc. XYZ Plc. Profit Plan For the year ending Dec. 31, 2020 Sales Revenue $12.600,000 Net Income 53.720,000 Total Assets S9,400,000 Operating Assets $3.400.000 Total Liabilities $3,200,000 WACC 21.66 Tax rate 1096 Return from Project A 328,000 Cost of project A $273,000 Required: Compute and analyze the: - Return on Investment (ROI) for project A - Return on Equity (ROE) and its components for the company. Residual income (RI) [Marks: (8+12) = 20 Question 3: (20 marks) Sabah Company has $900,000 to invest and wishes to evaluate the following three projects. Years X (S) Y(S) Z(S) 420.000 450,000 450.000 150,000 270,000 300,000 2 150,000 60,000 130,000 3 150,000 120,000 150,000 4 150,000 180,000 cost of capital 12% 12% 12% 0 1 Required: Which project(s) would you recommend using: a. Payback Period (PP) in nominal and discounted values. b. Net Present Value (NPV) c. Profitability Index (PI) d. The internal rate of return (IRR) (hint: use 30% for X and Y, and 5% for Z) Marks: (4+6+3+7) = 20)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts