Question: Question 2 (20 marks) (a) You have 40 years left until retirement and want to retire with $3 million. Your annual salary is now $100,000

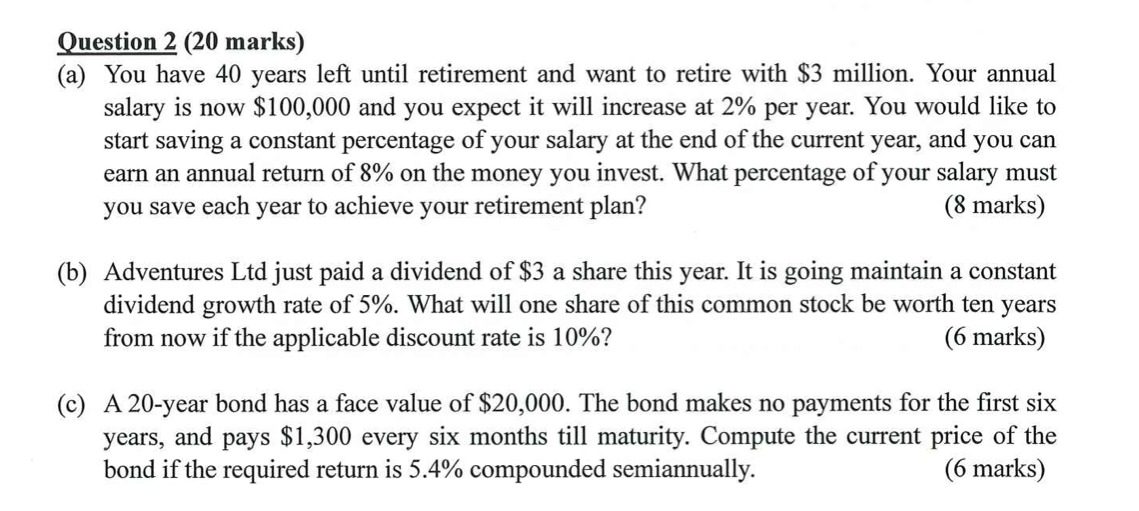

Question 2 (20 marks) (a) You have 40 years left until retirement and want to retire with $3 million. Your annual salary is now $100,000 and you expect it will increase at 2% per year. You would like to start saving a constant percentage of your salary at the end of the current year, and you can earn an annual return of 8% on the money you invest. What percentage of your salary must year to achieve your retirement plan? (8 marks) you save each (b) Adventures Ltd just paid a dividend of $3 a share this year. It is going maintain a constant dividend growth rate of 5%. What will one share of this common stock be worth ten years from now if the applicable discount rate is 10%? (6 marks) (C) A 20-year bond has a face value of $20,000. The bond makes no payments for the first six years, and pays $1,300 every six months till maturity. Compute the current price of the bond if the required return is 5.4% compounded semiannually. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts