Question: Question 2 (20 marks) (a) You have studied 2 stocks traded on an organized exchange and have found the following information: Stock X Y Beta

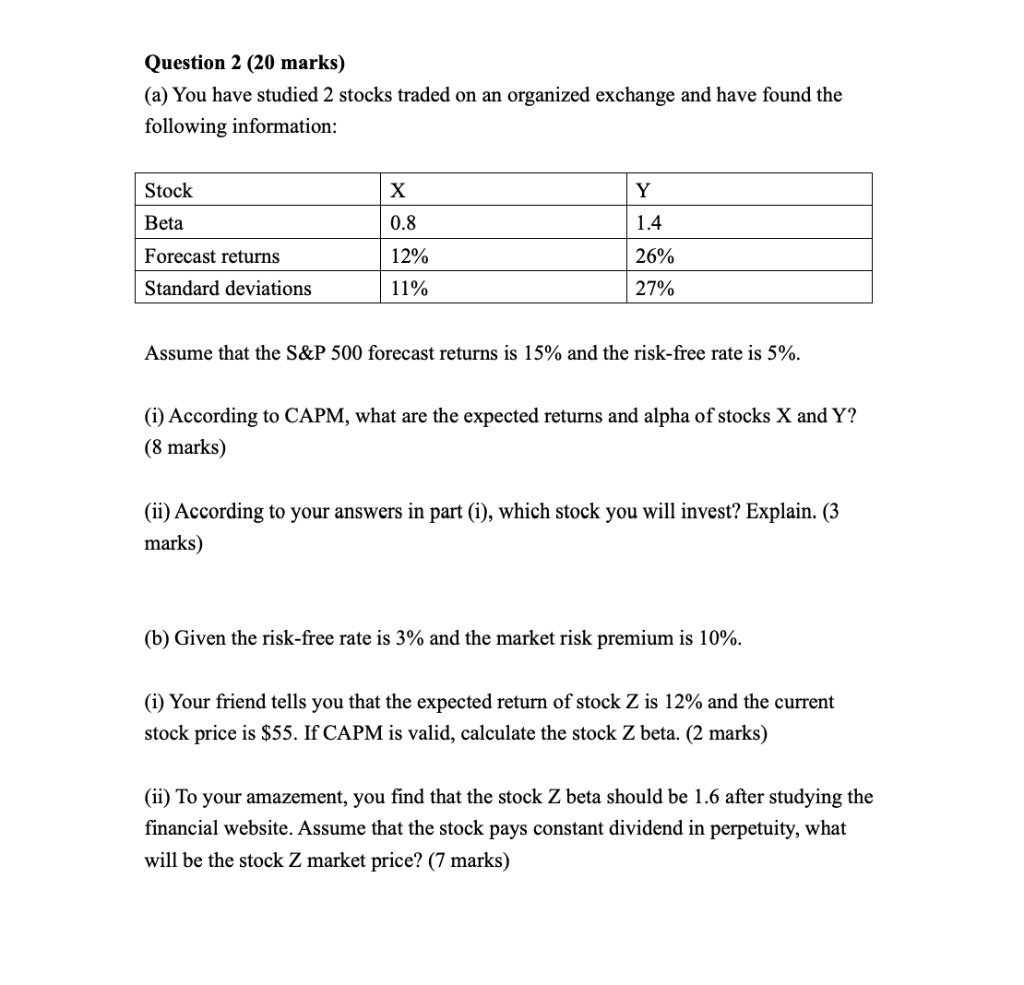

Question 2 (20 marks) (a) You have studied 2 stocks traded on an organized exchange and have found the following information: Stock X Y Beta 0.8 1.4 26% Forecast returns Standard deviations 12% 11% 27% Assume that the S&P 500 forecast returns is 15% and the risk-free rate is 5%. (i) According to CAPM, what are the expected returns and alpha of stocks X and Y? (8 marks) (ii) According to your answers in part (i), which stock you will invest? Explain. (3 marks) (b) Given the risk-free rate is 3% and the market risk premium is 10%. (i) Your friend tells you that the expected return of stock Z is 12% and the current stock price is $55. If CAPM is valid, calculate the stock Z beta. (2 marks) (ii) To your amazement, you find that the stock Z beta should be 1.6 after studying the financial website. Assume that the stock pays constant dividend in perpetuity, what will be the stock Z market price? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts