Question: Question 2 (20 marks) At time 0 you enter a T-year payer swap, locking in a swap rate equal to s(0) >0. a. At time

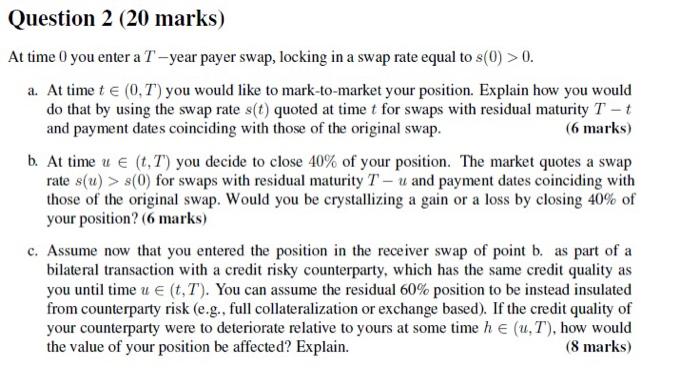

Question 2 (20 marks) At time 0 you enter a T-year payer swap, locking in a swap rate equal to s(0) >0. a. At time t (0,T) you would like to mark-to-market your position. Explain how you would do that by using the swap rate s(t) quoted at time t for swaps with residual maturity T - t and payment dates coinciding with those of the original swap. (6 marks) b. At time u (t,T) you decide to close 40% of your position. The market quotes a swap rate s(u) > $(0) for swaps with residual maturity T - U and payment dates coinciding with those of the original swap. Would you be crystallizing a gain or a loss by closing 40% of your position? (6 marks) c. Assume now that you entered the position in the receiver swap of point b. as part of a bilateral transaction with a credit risky counterparty, which has the same credit quality as you until time u e(t,T). You can assume the residual 60% position to be instead insulated from counterparty risk (e.g., full collateralization or exchange based). If the credit quality of your counterparty were to deteriorate relative to yours at some time he (u. T), how would the value of your position be affected? Explain. (8 marks) Question 2 (20 marks) At time 0 you enter a T-year payer swap, locking in a swap rate equal to s(0) >0. a. At time t (0,T) you would like to mark-to-market your position. Explain how you would do that by using the swap rate s(t) quoted at time t for swaps with residual maturity T - t and payment dates coinciding with those of the original swap. (6 marks) b. At time u (t,T) you decide to close 40% of your position. The market quotes a swap rate s(u) > $(0) for swaps with residual maturity T - U and payment dates coinciding with those of the original swap. Would you be crystallizing a gain or a loss by closing 40% of your position? (6 marks) c. Assume now that you entered the position in the receiver swap of point b. as part of a bilateral transaction with a credit risky counterparty, which has the same credit quality as you until time u e(t,T). You can assume the residual 60% position to be instead insulated from counterparty risk (e.g., full collateralization or exchange based). If the credit quality of your counterparty were to deteriorate relative to yours at some time he (u. T), how would the value of your position be affected? Explain. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts