Question: Question 2 (20 Marks) Dodo Sdn Bhd produced three products A, B and C. The following information has been extracted from its budget for the

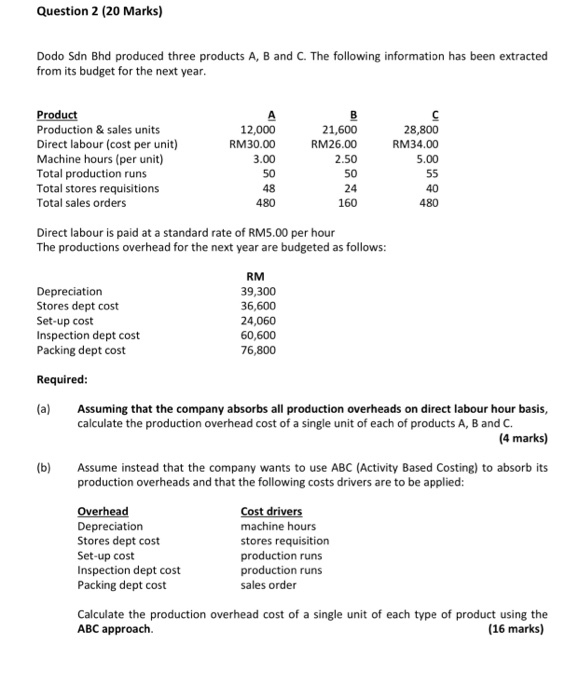

Question 2 (20 Marks) Dodo Sdn Bhd produced three products A, B and C. The following information has been extracted from its budget for the next year. Product A B Production & sales units 12,000 21,600 28,800 Direct labour cost per unit) RM 30.00 RM26.00 RM34.00 Machine hours (per unit) 3.00 2.50 5.00 Total production runs 50 50 55 Total stores requisitions 48 24 40 Total sales orders 480 160 480 Direct labour is paid at a standard rate of RM5.00 per hour The productions overhead for the next year are budgeted as follows: Depreciation Stores dept cost Set-up cost Inspection dept cost Packing dept cost RM 39,300 36,600 24,060 60,600 76,800 Required: (a) (b) Assuming that the company absorbs all production overheads on direct labour hour basis, calculate the production overhead cost of a single unit of each of products A, B and C. (4 marks) Assume instead that the company wants to use ABC (Activity Based Costing) to absorb its production overheads and that the following costs drivers are to be applied: Overhead Cost drivers Depreciation machine hours Stores dept cost stores requisition Set-up cost production runs Inspection dept cost production runs Packing dept cost sales order Calculate the production overhead cost of a single unit of each type of product using the ABC approach. (16 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts