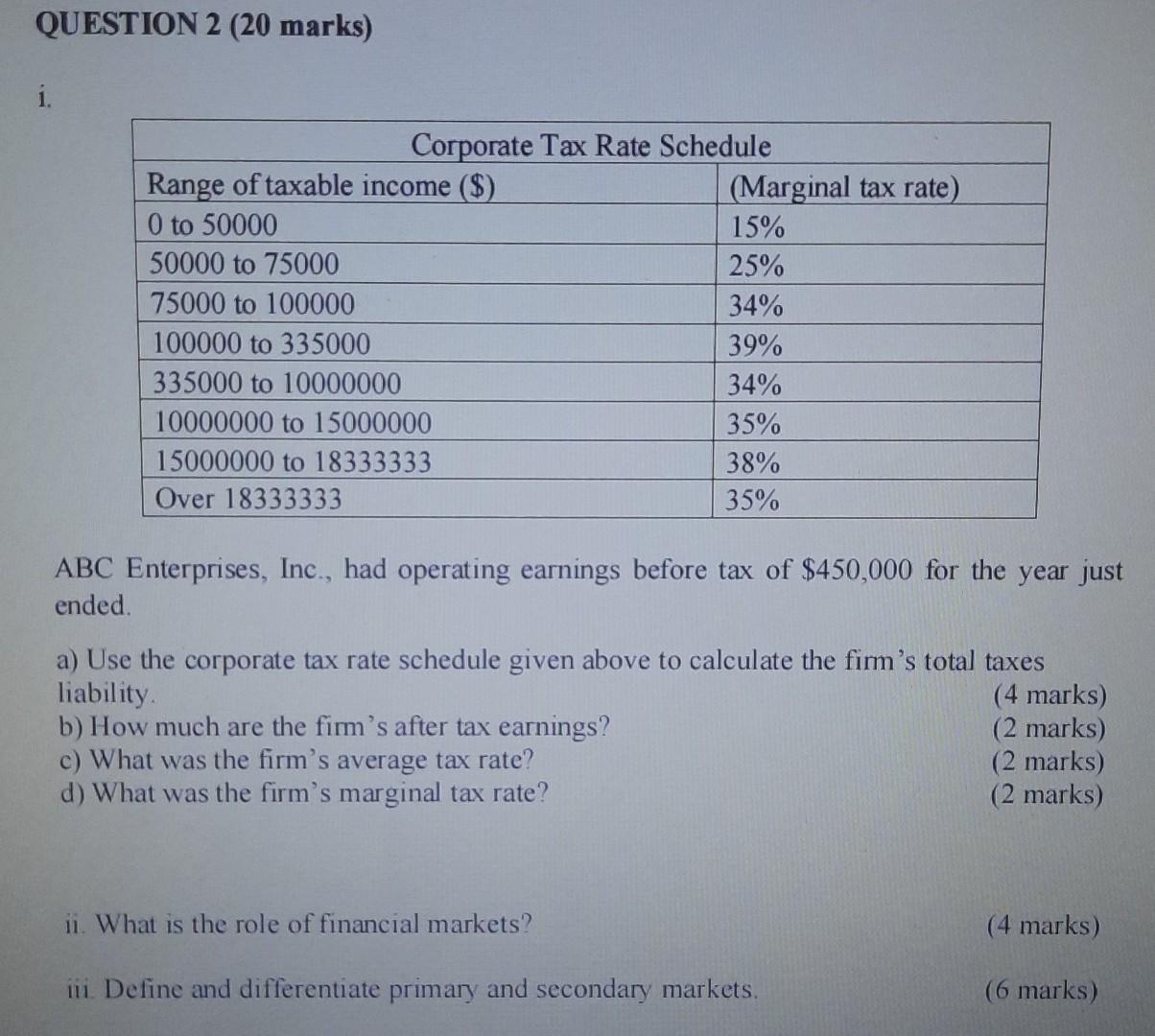

Question: QUESTION 2 (20 marks) i. Corporate Tax Rate Schedule Range of taxable income ($) (Marginal tax rate) 0 to 50000 15% 50000 to 75000 25%

QUESTION 2 (20 marks) i. Corporate Tax Rate Schedule Range of taxable income ($) (Marginal tax rate) 0 to 50000 15% 50000 to 75000 25% 75000 to 100000 34% 100000 to 335000 39% 335000 to 10000000 34% 10000000 to 15000000 35% 15000000 to 18333333 38% Over 18333333 35% ABC Enterprises, Inc., had operating earnings before tax of $450,000 for the year just ended. a) Use the corporate tax rate schedule given above to calculate the firm's total taxes liability (4 marks) b) How much are the firm's after tax earnings? (2 marks) c) What was the firm's average tax rate? (2 marks) d) What was the firm's marginal tax rate? (2 marks) i. What is the role of financial markets? (4 marks) iniDefine and differentiate primary and secondary markets. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts