Question: Question 2 (20 marks) Jane is the financial manager for Alpha Corporation. She has been asked to perform a lease-versus-purchase analysis on a new printing

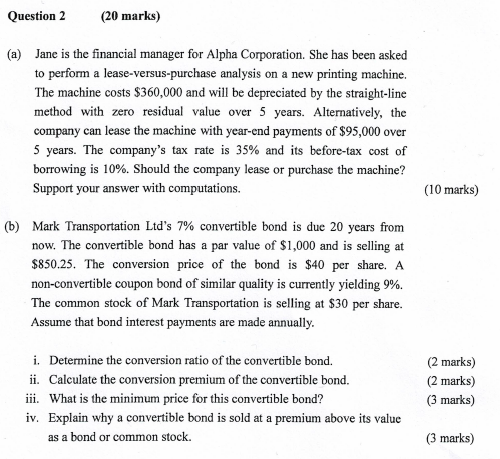

Question 2 (20 marks) Jane is the financial manager for Alpha Corporation. She has been asked to perform a lease-versus-purchase analysis on a new printing machine. The machine costs $360,000 and wll be depreciated by the straight-line method with zero residual value over 5 years. Alternatively, the company can lease the machine with year-end payments of $95,000 over 5 years. The company's tax rate is 35% and its before-tax cost of borrowing is 10%. Should the company lease or purchase the machine? Support your answer with computations. (a) (10 marks) (b) Mark Transportation Ltd's 7% convertible bond is due 20 years from now. The convertible bond has a par value of $1,000 and is selling at S850.25. The conversion price of the bond is $40 per share. A non-convertible coupon bond of similar quality is currently yielding 9%. The common stock of Mark Transportation is selling at $30 per share. Assume that bond interest payments are made annually i. Determine the conversion ratio of the convertible bond. ii. Calculate the conversion premium of the convertible bond. iii. What is the minimum price for this convertible bond? iv. Explain why a convertible bond is sold at a premium above its value (2 marks) (2 marks) (3 marks) as a bond or common stock (3 marks) Question 2 (20 marks) Jane is the financial manager for Alpha Corporation. She has been asked to perform a lease-versus-purchase analysis on a new printing machine. The machine costs $360,000 and wll be depreciated by the straight-line method with zero residual value over 5 years. Alternatively, the company can lease the machine with year-end payments of $95,000 over 5 years. The company's tax rate is 35% and its before-tax cost of borrowing is 10%. Should the company lease or purchase the machine? Support your answer with computations. (a) (10 marks) (b) Mark Transportation Ltd's 7% convertible bond is due 20 years from now. The convertible bond has a par value of $1,000 and is selling at S850.25. The conversion price of the bond is $40 per share. A non-convertible coupon bond of similar quality is currently yielding 9%. The common stock of Mark Transportation is selling at $30 per share. Assume that bond interest payments are made annually i. Determine the conversion ratio of the convertible bond. ii. Calculate the conversion premium of the convertible bond. iii. What is the minimum price for this convertible bond? iv. Explain why a convertible bond is sold at a premium above its value (2 marks) (2 marks) (3 marks) as a bond or common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts