Question: Question 2 - 20 marks Question 2 - 20 marks On 1 July 2020, Laurel Ltd acquired the remaining 75% of the issued shares that

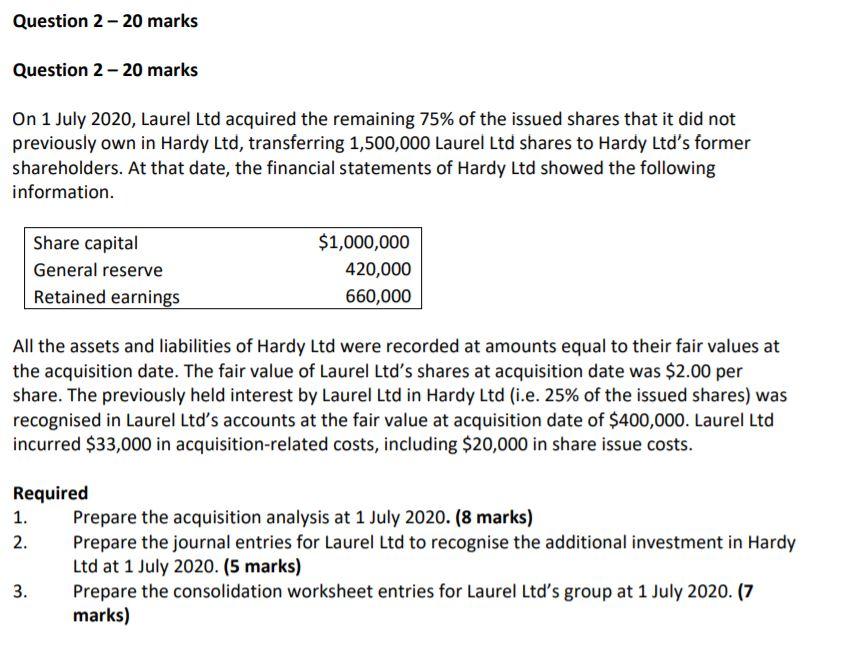

Question 2 - 20 marks Question 2 - 20 marks On 1 July 2020, Laurel Ltd acquired the remaining 75% of the issued shares that it did not previously own in Hardy Ltd, transferring 1,500,000 Laurel Ltd shares to Hardy Ltd's former shareholders. At that date, the financial statements of Hardy Ltd showed the following information. Share capital General reserve Retained earnings $1,000,000 420,000 660,000 All the assets and liabilities of Hardy Ltd were recorded at amounts equal to their fair values at the acquisition date. The fair value of Laurel Ltd's shares at acquisition date was $2.00 per share. The previously held interest by Laurel Ltd in Hardy Ltd (i.e. 25% of the issued shares) was recognised in Laurel Ltd's accounts at the fair value at acquisition date of $400,000. Laurel Ltd incurred $33,000 in acquisition-related costs, including $20,000 in share issue costs. Required 1. Prepare the acquisition analysis at 1 July 2020. (8 marks) 2. Prepare the journal entries for Laurel Ltd to recognise the additional investment in Hardy Ltd at 1 July 2020. (5 marks) 3. Prepare the consolidation worksheet entries for Laurel Ltd's group at 1 July 2020. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts