Question: Question 2 - 20 marks Reece noted in the article, that trade in their smallest market, New Zealand had been 'well down, and likely to

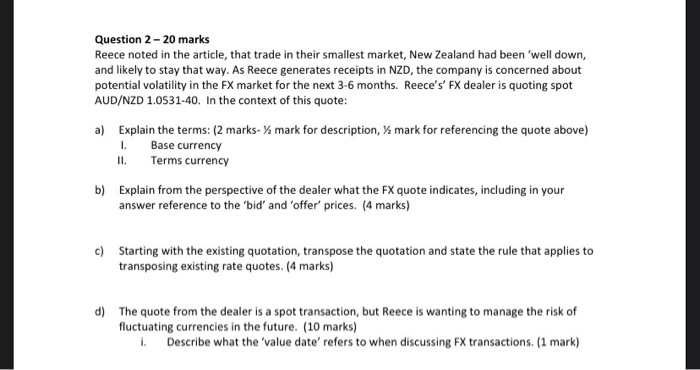

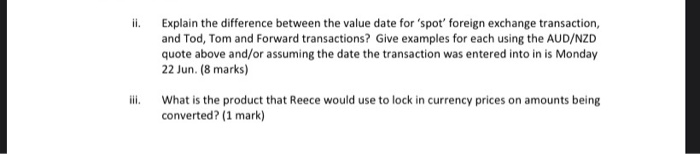

Question 2 - 20 marks Reece noted in the article, that trade in their smallest market, New Zealand had been 'well down, and likely to stay that way. As Reece generates receipts in NZD, the company is concerned about potential volatility in the FX market for the next 3-6 months. Reece's' FX dealer is quoting Spot AUD/NZD 1.0531-40. In the context of this quote: a) Explain the terms: (2 marks- mark for description, y mark for referencing the quote above) Base currency II. Terms currency b) Explain from the perspective of the dealer what the FX quote indicates, including in your answer reference to the 'bid' and 'offer' prices. (4 marks) 1. c) Starting with the existing quotation, transpose the quotation and state the rule that applies to transposing existing rate quotes. (4 marks) d) The quote from the dealer is a spot transaction, but Reece is wanting to manage the risk of fluctuating currencies in the future. (10 marks) i. Describe what the 'value date' refers to when discussing FX transactions. (1 mark) ii. Explain the difference between the value date for 'spot' foreign exchange transaction, and Tod, Tom and Forward transactions? Give examples for each using the AUD/NZD quote above and/or assuming the date the transaction was entered into in is Monday 22 Jun (8 marks) What is the product that Reece would use to lock in currency prices on amounts being converted? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts