Question: QUESTION 2 (20 Marks) REQUIRED Use the information provided below to answer the following questions: 2.1 Calculate the following ratios. Express the answers to two

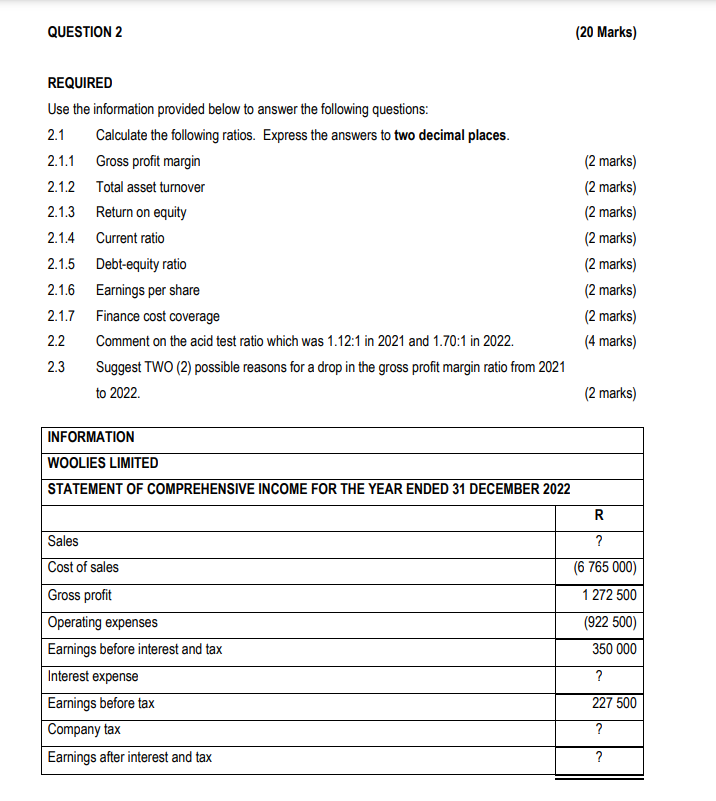

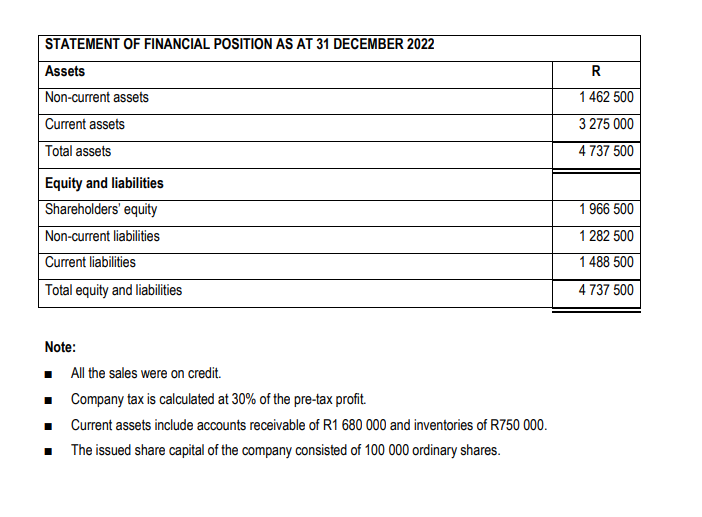

QUESTION 2 (20 Marks) REQUIRED Use the information provided below to answer the following questions: 2.1 Calculate the following ratios. Express the answers to two decimal places. 2.1.1 Gross profit margin (2 marks) 2.1.2 Total asset turnover (2 marks) 2.1.3 Return on equity (2 marks) 2.1.4 Current ratio (2 marks) 2.1.5 Debt-equity ratio (2 marks) 2.1.6 Earnings per share (2 marks) 2.1.7 Finance cost coverage (2 marks) 2.2 Comment on the acid test ratio which was 1.12:1 in 2021 and 1.70:1 in 2022. (4 marks) 2.3 Suggest TWO (2) possible reasons for a drop in the gross profit margin ratio from 2021 to 2022. (2 marks) \\begin{tabular}{|l|c|} \\hline INFORMATION \\\\ \\hline WOOLIES LIMITED & R \\\\ \\hline STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 \\\\ \\hline & \\( ? \\) \\\\ \\hline Sales & \\( (6765000) \\) \\\\ \\hline Cost of sales & 1272500 \\\\ \\hline Gross profit & \\( (922500) \\) \\\\ \\hline Operating expenses & 350000 \\\\ \\hline Earnings before interest and tax & \\( ? \\) \\\\ \\hline Interest expense & 227500 \\\\ \\hline Earnings before tax & \\( ? \\) \\\\ \\hline Company tax & \\( ? \\) \\\\ \\hline Earnings after interest and tax & \\( ? \\) \\\\ \\hline \\end{tabular} Note: - All the sales were on credit. - Company tax is calculated at \30 of the pre-tax profit. - Current assets include accounts receivable of R1 680000 and inventories of R750 000 . - The issued share capital of the company consisted of 100000 ordinary shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts