Question: QUESTION 2 (20 Marks) REQUIRED Use the information provided in QUESTION 1 to answer the following questions: 2.1 Calculate the ratios for 2021 (expressed to

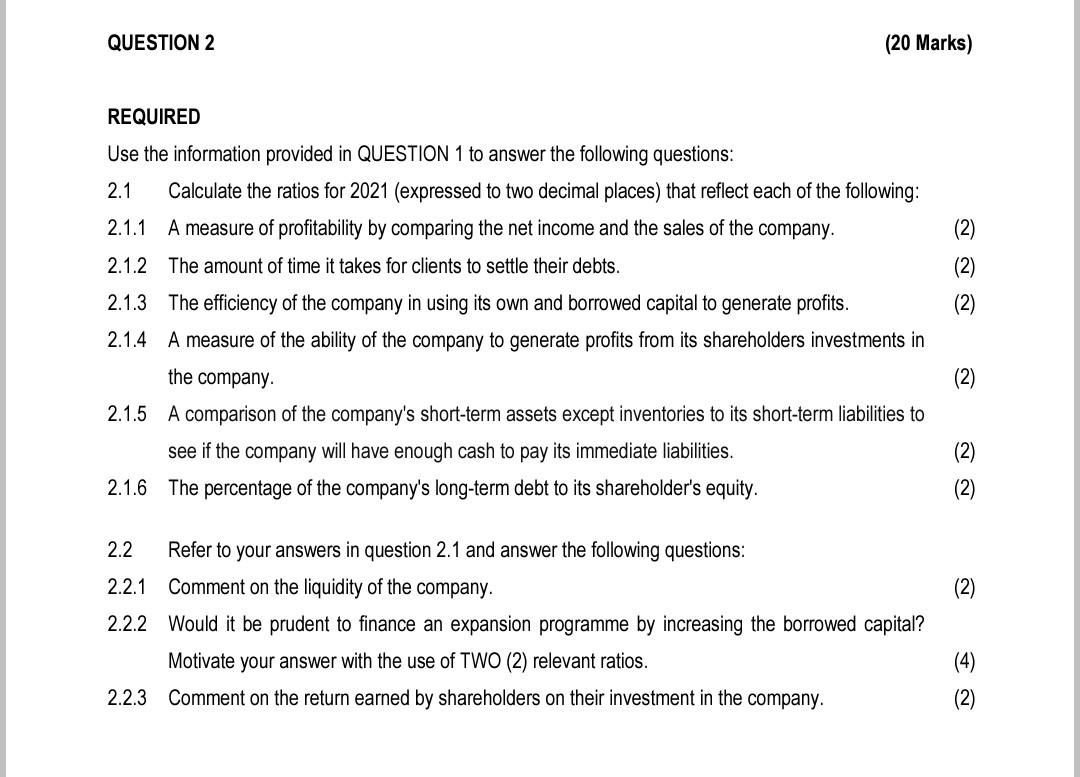

QUESTION 2 (20 Marks) REQUIRED

Use the information provided in QUESTION 1 to answer the following questions:

2.1 Calculate the ratios for 2021 (expressed to two decimal places) that reflect each of the following:

2.1.1 A measure of profitability by comparing the net income and the sales of the company. (2) 2.1.2 The amount of time it takes for clients to settle their debts. (2)

2.1.3 The efficiency of the company in using its own and borrowed capital to generate profits. (2)

2.1.4 A measure of the ability of the company to generate profits from its shareholders investments in the company. (2)

2.1.5 A comparison of the company's short-term assets except inventories to its short-term liabilities to see if the company will have enough cash to pay its immediate liabilities. (2)

2.1.6 The percentage of the company's long-term debt to its shareholder's equity. (2)

2.2 Refer to your answers in question 2.1 and answer the following questions:

2.2.1 Comment on the liquidity of the company. (2)

2.2.2 Would it be prudent to finance an expansion programme by increasing the borrowed capital? Motivate your answer with the use of TWO (2) relevant ratios. (4)

2.2.3 Comment on the return earned by shareholders on their investment in the company. (2)

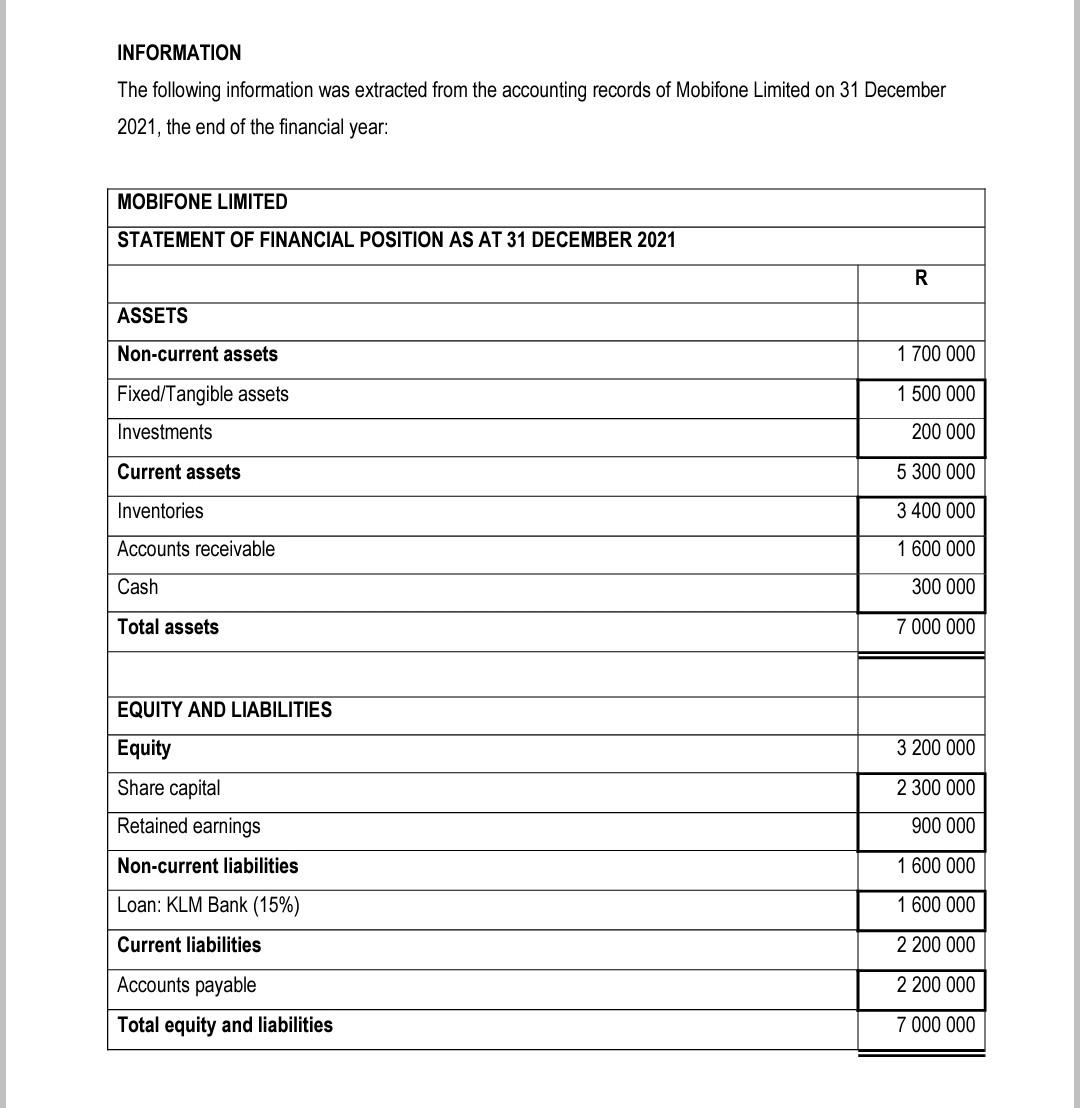

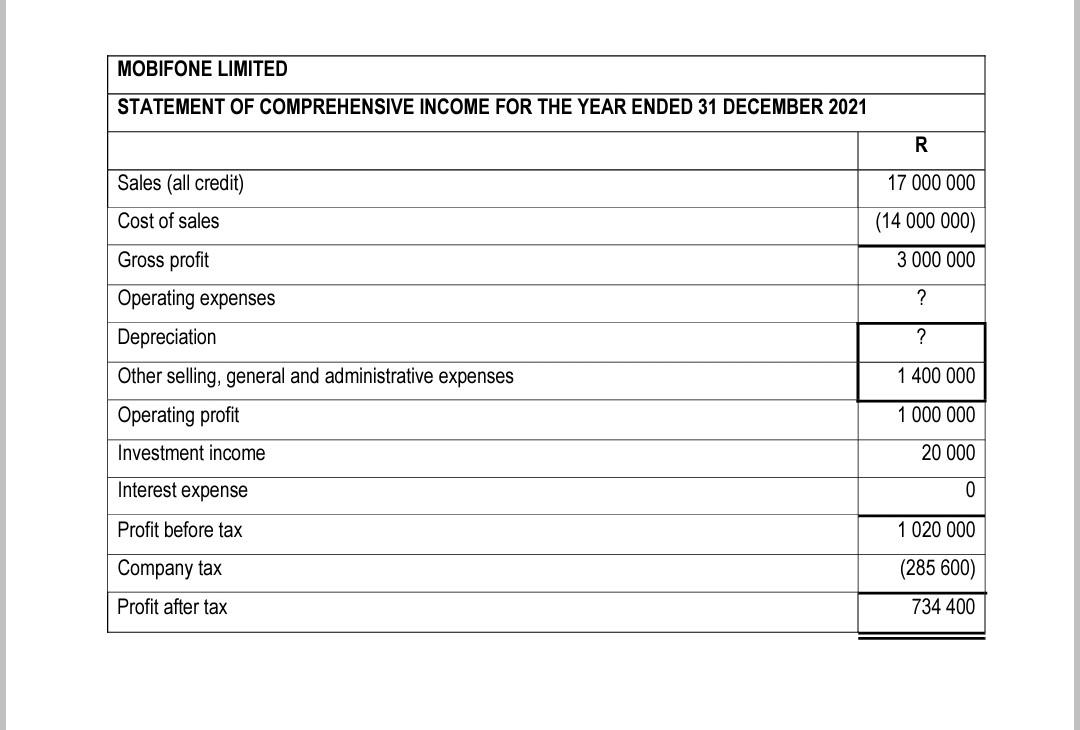

QUESTION 2 (20 Marks) REQUIRED (2) Use the information provided in QUESTION 1 to answer the following questions: 2.1 Calculate the ratios for 2021 (expressed to two decimal places) that reflect each of the following: 2.1.1 A measure of profitability by comparing the net income and the sales of the company. 2.1.2 The amount of time it takes for clients to settle their debts. 2.1.3 The efficiency of the company in using its own and borrowed capital to generate profits. 2.1.4 A measure of the ability of the company to generate profits from its shareholders investments in (2) (2) the company. (2) 2.1.5 A comparison of the company's short-term assets except inventories to its short-term liabilities to see if the company will have enough cash to pay its immediate liabilities. 2.1.6 The percentage of the company's long-term debt to its shareholder's equity. (2) (2) (2) 2.2 Refer to your answers in question 2.1 and answer the following questions: 2.2.1 Comment on the liquidity of the company. 2.2.2 Would it be prudent to finance an expansion programme by increasing the borrowed capital? Motivate your answer with the use of TWO (2) relevant ratios. 2.2.3 Comment on the return earned by shareholders on their investment in the company. (4) (2) INFORMATION The following information was extracted from the accounting records of Mobifone Limited on 31 December 2021, the end of the financial year: MOBIFONE LIMITED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 R ASSETS Non-current assets 1 700 000 Fixed/Tangible assets 1 500 000 Investments 200 000 Current assets 5 300 000 Inventories 3 400 000 Accounts receivable 1 600 000 Cash 300 000 Total assets 7 000 000 EQUITY AND LIABILITIES 3 200 000 Equity Share capital Retained earnings 2 300 000 900 000 Non-current liabilities 1 600 000 Loan: KLM Bank (15%) 1 600 000 Current liabilities 2 200 000 Accounts payable 2 200 000 Total equity and liabilities 7 000 000 MOBIFONE LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 R Sales (all credit) 17 000 000 Cost of sales (14 000 000) 3 000 000 Gross profit Operating expenses ? ? Depreciation Other selling, general and administrative expenses Operating profit 1 400 000 1 000 000 Investment income 20 000 Interest expense 0 Profit before tax 1 020 000 Company tax (285 600) 734 400 Profit after tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts