Question: Question 2 (20 Marks) Topic: Leases (for lessees) Answer both parts independently of each other. Part A (12 marks) Supply Ltd entered into a non-cancellable

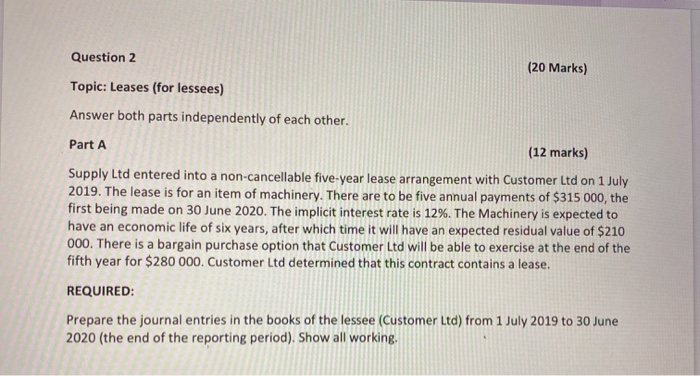

Question 2 (20 Marks) Topic: Leases (for lessees) Answer both parts independently of each other. Part A (12 marks) Supply Ltd entered into a non-cancellable five-year lease arrangement with Customer Ltd on 1 July 2019. The lease is for an item of machinery. There are to be five annual payments of $315 000, the first being made on 30 June 2020. The implicit interest rate is 12%. The Machinery is expected to have an economic life of six years, after which time it will have an expected residual value of $210 000. There is a bargain purchase option that Customer Ltd will be able to exercise at the end of the fifth year for $280 000. Customer Ltd determined that this contract contains a lease. REQUIRED: Prepare the journal entries in the books of the lessee (Customer Ltd) from 1 July 2019 to 30 June 2020 (the end of the reporting period). Show all working

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts