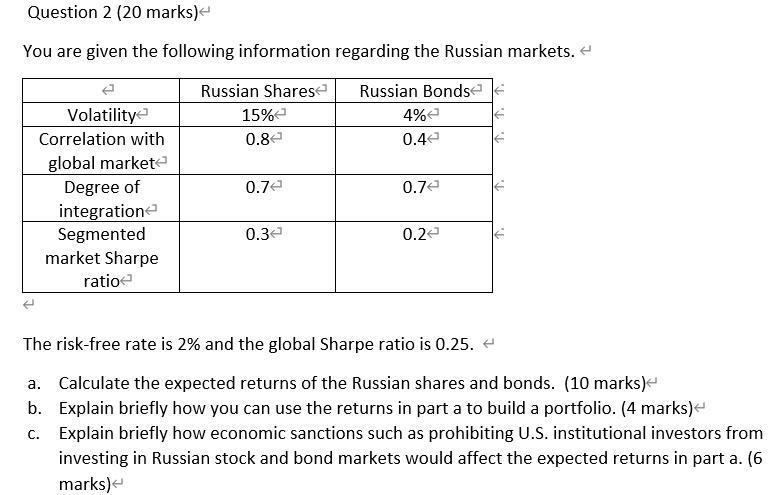

Question: Question 2 (20 marks) You are given the following information regarding the Russian markets. Russian Shares 15% 0.84 Russian Bonds 4% 0.42 1.1.1. 0.72 0.72

Question 2 (20 marks) You are given the following information regarding the Russian markets. Russian Shares 15% 0.84 Russian Bonds 4% 0.42 1.1.1. 0.72 0.72 Volatility Correlation with global market Degree of integratione Segmented market Sharpe ratio 0.32 0.22 1. The risk-free rate is 2% and the global Sharpe ratio is 0.25.4 a. Calculate the expected returns of the Russian shares and bonds. (10 marks) b. Explain briefly how you can use the returns in part a to build a portfolio. (4 marks) C. Explain briefly how economic sanctions such as prohibiting U.S. institutional investors from investing in Russian stock and bond markets would affect the expected returns in part a. (6 marks) Question 2 (20 marks) You are given the following information regarding the Russian markets. Russian Shares 15% 0.84 Russian Bonds 4% 0.42 1.1.1. 0.72 0.72 Volatility Correlation with global market Degree of integratione Segmented market Sharpe ratio 0.32 0.22 1. The risk-free rate is 2% and the global Sharpe ratio is 0.25.4 a. Calculate the expected returns of the Russian shares and bonds. (10 marks) b. Explain briefly how you can use the returns in part a to build a portfolio. (4 marks) C. Explain briefly how economic sanctions such as prohibiting U.S. institutional investors from investing in Russian stock and bond markets would affect the expected returns in part a. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts