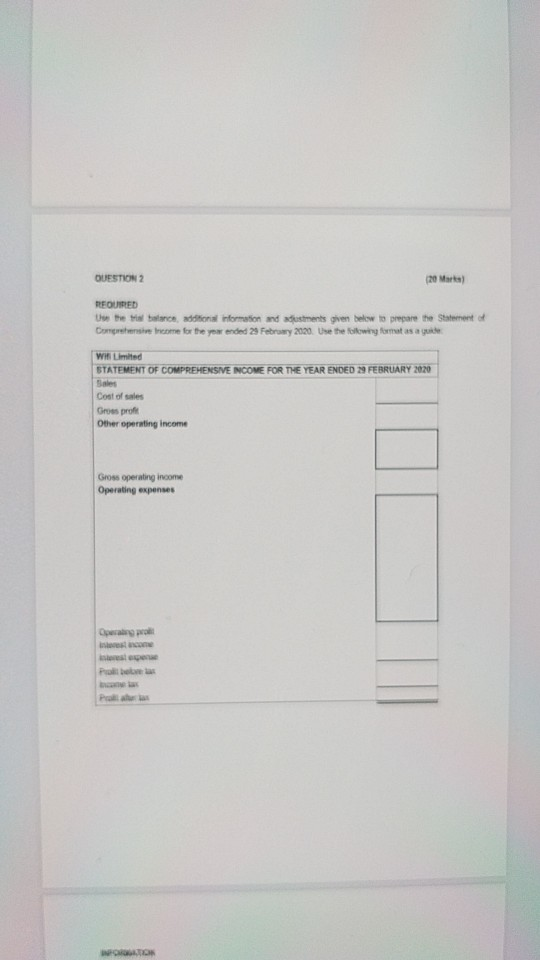

Question: QUESTION 2 20 Marta REQUIRED U the balance additional formation and adjustments given below to prepare the Statement of Congrese come for the year ended

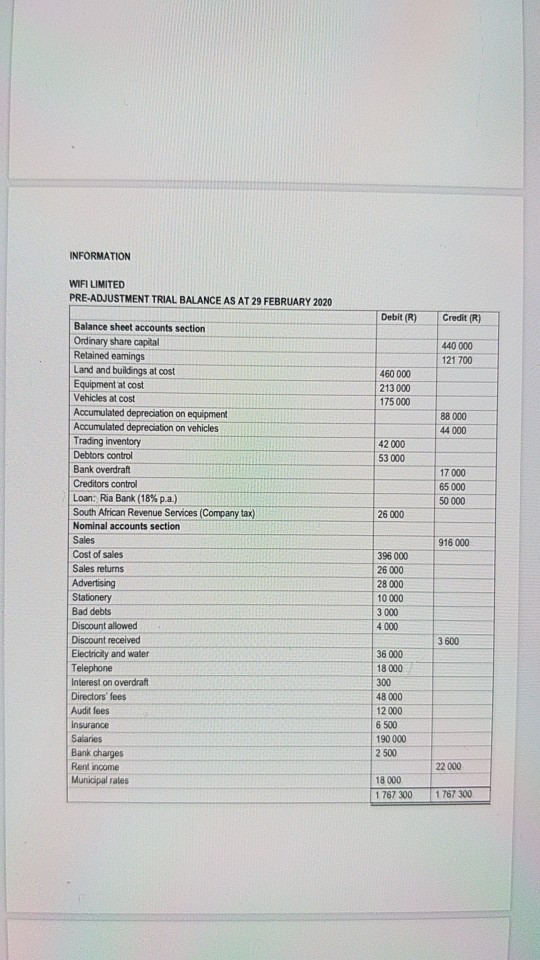

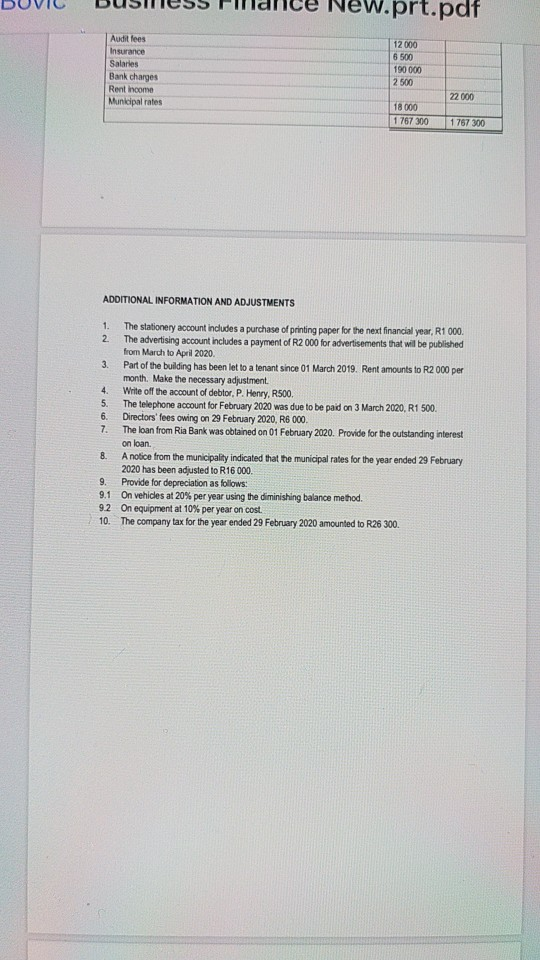

QUESTION 2 20 Marta REQUIRED U the balance additional formation and adjustments given below to prepare the Statement of Congrese come for the year ended 23 February 2020. Use the following formatas ayude WiLimited STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 29 FEBRUARY 2020 Cost of sales Gros profe Other operating income Gross operating income Operating expenses INFO INFORMATION WIFI LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 29 FEBRUARY 2020 Debit (R) Credit (R) 440 000 121 700 460 000 213 000 175 000 88 000 44000 42 000 53 000 17 000 65 000 50 000 26 000 916 000 Balance sheet accounts section Ordinary share capital Retained earings Land and buildings at cost Equipment at cost Vehicles at cost Accumulated depreciation on equipment Accumulated depreciation on vehicles Trading inventory Debtors control Bank overdraft Creditors control Loan: Ria Bank (18% p.a.) South African Revenue Services (Company tax) Nominal accounts section Sales Cost of sales Sales returns Advertising Stationery Bad debts Discount allowed Discount received Electricity and water Telephone Interest on overdraft Directors' fees Audit fees Insurance Salaries Bank charges Rent income Municipal rates 396 000 26 000 28 000 10 000 3000 4000 3 600 36 000 18 000 300 48 000 12 000 6 500 190 000 2 500 22 000 18 000 1 767 300 1767 300 ew.prt.pdf Audit lees Insurance Salaries Bank charges Rent income Municipal rates 12 000 6 500 190 000 2500 22.000 18 000 1767 300 1 757300 ADDITIONAL INFORMATION AND ADJUSTMENTS 1. The stationery account includes a purchase of printing paper for the next financial year, R1 000. 2 The advertising account includes a payment of R2 000 for advertisements that will be published from March to April 2020. 3. Part of the building has been let to a tenant since 01 March 2019. Rent amounts to R2 000 per month. Make the necessary adjustment 4. Write off the account of debtor, P. Henry, R500, 5. The telephone account for February 2020 was due to be paid on 3 March 2020, R1 500. 6. Directors' fees owing on 29 February 2020, R6 000 7. The loan from Ria Bank was obtained on 01 February 2020. Provide for the outstanding interest on loan 8 A notice from the municipality indicated that the municipal rates for the year ended 29 February 2020 has been adjusted to R16 000 9. Provide for depreciation as follows: 9.1 On vehicles at 20% per year using the diminishing balance method. 92 On equipment at 10% per year on cost. 10. The company tax for the year ended 29 February 2020 amounted to R26 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts