Question: QUESTION 2 20 points (For this problem, I recommend you work with Excel and copy your clean answettable here) Stock valuation using FCF (Show all

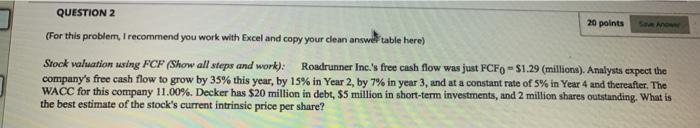

QUESTION 2 20 points (For this problem, I recommend you work with Excel and copy your clean answettable here) Stock valuation using FCF (Show all steps and work): Roadrunner Inc.'s free cash flow was just FCF0 - $1.29 (millions). Analysts expect the company's free cash flow to grow by 35% this year, by 15% in Year 2, by 7% in year 3, and at a constant rate of 5% in Year 4 and thereafter. The WACC for this company 11.00%. Decker has $20 million in debt, $5 million in short-term investments, and 2 million shares outstanding. What is the best estimate of the stock's current intrinsic price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts