Question: Question 2 [20 points] Given the following, prepare the entries that both the purchaser and seller should record for these transactions. Assume both companies use

![Question 2 [20 points] Given the following, prepare the entries that](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e9e27981ac9_89666e9e278d5aed.jpg)

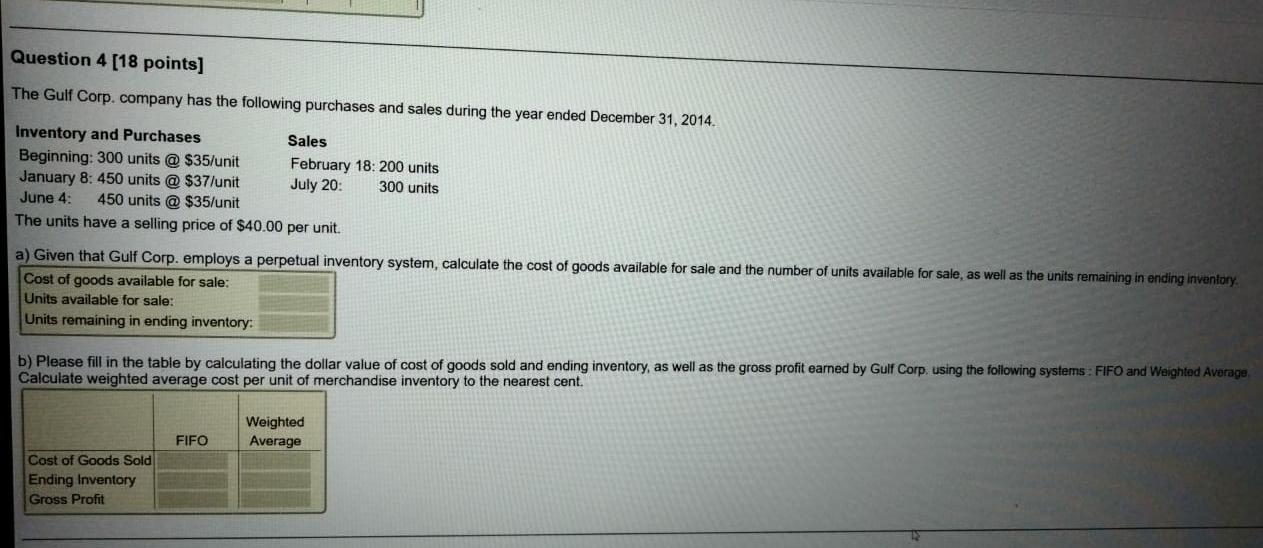

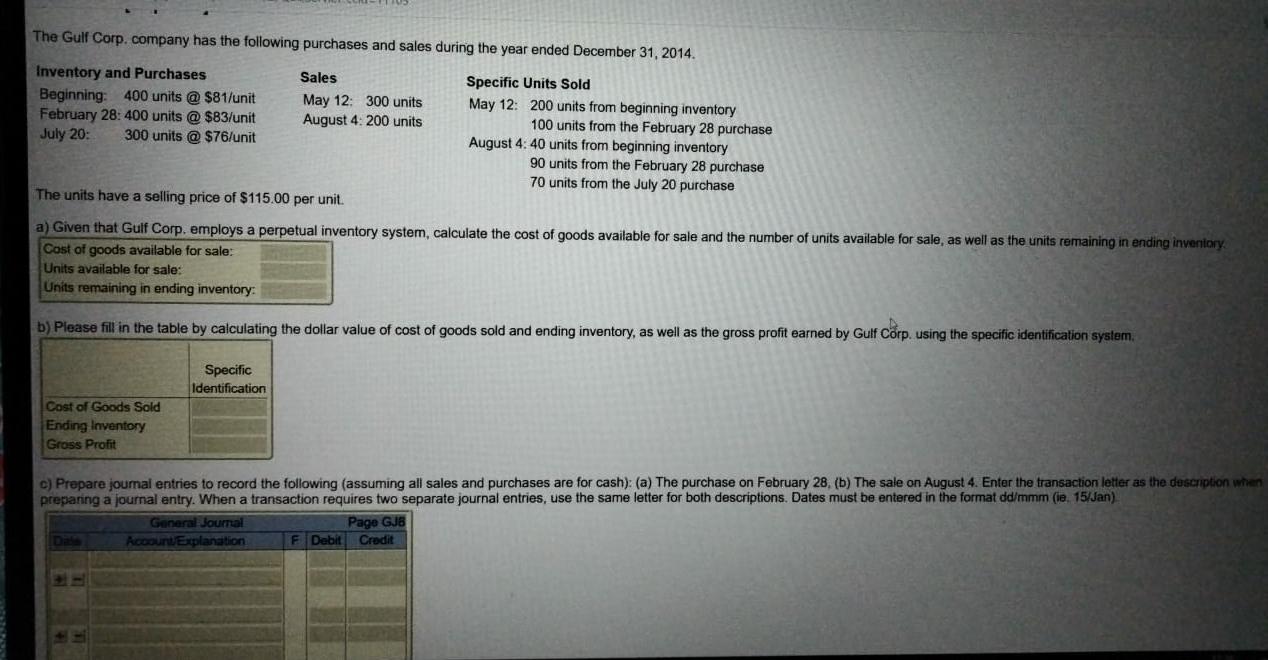

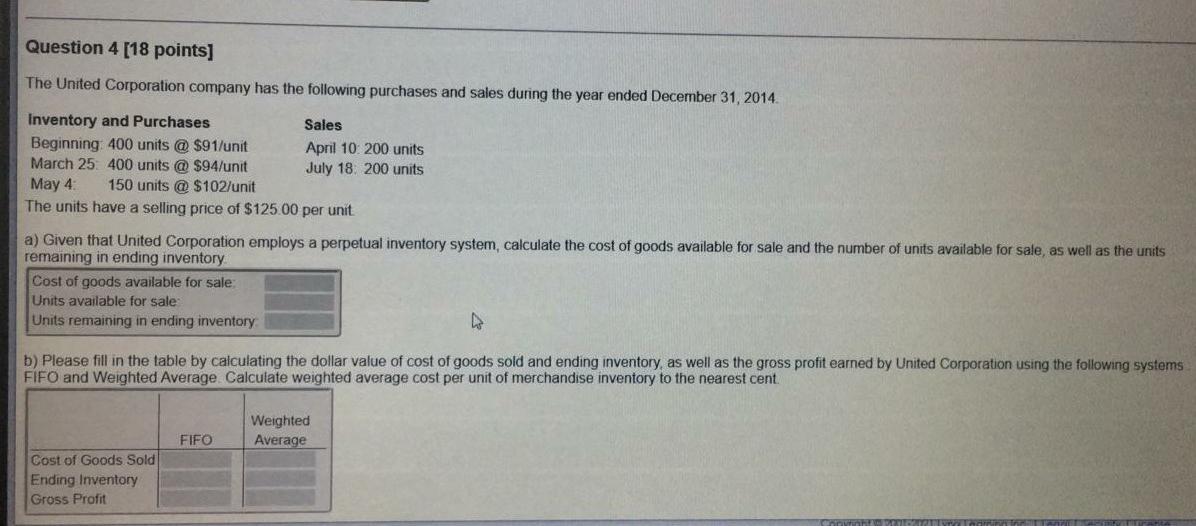

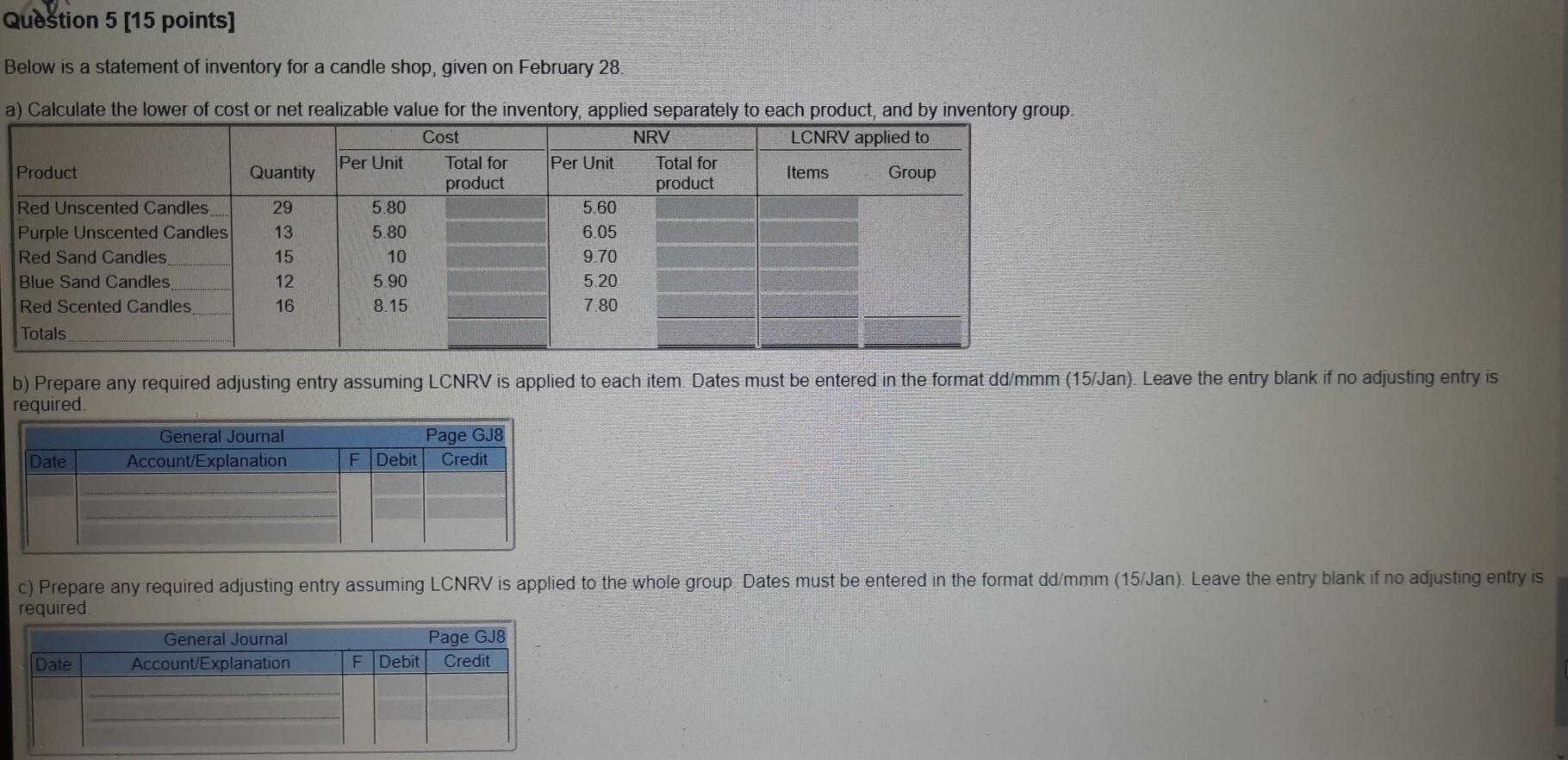

Question 2 [20 points] Given the following, prepare the entries that both the purchaser and seller should record for these transactions. Assume both companies use a perpetual inventory system a. October 13: Stake Technology Inc. sold merchandise that cost $5,015 to Global Filter Corp for $5,900 under credit terms of n/60, FOB shipping point b. October 23: Global Filter Corp. paid Stake Technology Inc. the balance due. Enter the transaction letter as the description when entering the transactions in the journal Dates must be entered in the format dd/mmm (1.e., January 15 would be 15/Jan Please use the 'F' and '.' buttons to change the number of accounts (if necessary) for each journal entry. a) Global Filter Corp. b) Stake Technology Inc. Page GT General Journal Account/Explanation Page GJ2 F Debit Credit General Journal Account/Explanation Date Date F Debit Credit + 1 + 1 Question 4 [18 points] The Gulf Corp. company has the following purchases and sales during the year ended December 31, 2014 Inventory and Purchases Sales Beginning: 300 units @ $35/unit February 18: 200 units January 8: 450 units @ $37/unit July 20 300 units June 4: 450 units @ $35/unit The units have a selling price of $40.00 per unit. a) Given that Gulf Corp. employs a perpetual inventory system, calculate the cost of goods available for sale and the number of units available for sale, as well as the units remaining in ending inventory Cost of goods available for sale: Units available for sale: Units remaining in ending inventory: b) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit earned by Gulf Corp. using the following systems : FIFO and Weighted Average Calculate weighted average cost per unit of merchandise inventory to the nearest cent. Weighted Average FIFO Cost of Goods Sold Ending Inventory Gross Profit The Gulf Corp. company has the following purchases and sales during the year ended December 31, 2014. Inventory and Purchases Beginning 400 units @ $81/unit February 28: 400 units @ $83/unit July 20: 300 units @ $76/unit Sales May 12: 300 units August 4: 200 units Specific Units Sold May 12: 200 units from beginning inventory 100 units from the February 28 purchase August 4: 40 units from beginning inventory 90 units from the February 28 purchase 70 units from the July 20 purchase The units have a selling price of $115.00 per unit. a) Given that Gulf Corp. employs a perpetual inventory system, calculate the cost of goods available for sale and the number of units available for sale, as well as the units remaining in ending inveniory. Cost of goods available for sale: Units available for sale: Units remaining in ending inventory b) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit earned by Gulf Corp. using the specific identification system, Specific Identification Cost of Goods Sold Ending Inventory Gross Profit c) Prepare journal entries to record the following (assuming all sales and purchases are for cash): (a) The purchase on February 28, (b) The sale on August 4. Enter the transaction letter as the deserption when preparing a journal entry. When a transaction requires two separate journal entries, use the same letter for both descriptions. Dates must be entered in the format dd/mmm (ie 15/Jan) General Journal Page GJE AccounExplanation F Debit Credit Question 4(18 points] The United Corporation company has the following purchases and sales during the year ended December 31, 2014 Inventory and Purchases Sales Beginning 400 units @ $91/unit April 10: 200 units March 25. 400 units @ $94/unit July 18, 200 units May 4 150 units @ $102/unit The units have a selling price of $125.00 per unit a) Given that United Corporation employs a perpetual inventory system, calculate the cost of goods available for sale and the number of units available for sale, as well as the units remaining in ending inventory Cost of goods available for sale: Units available for sale Units remaining in ending inventory b) Please fill in the table by calculating the dollar value of cost of goods sold and ending inventory, as well as the gross profit earned by United Corporation using the following systems FIFO and Weighted Average Calculate weighted average cost per unit of merchandise inventory to the nearest cent. Weighted Average FIFO Cost of Goods Sold Ending Inventory Gross Profit Question 5 [15 points] Below is a statement of inventory for a candle shop, given on February 28. a) Calculate the lower of cost or net realizable value for the inventory, applied separately to each product, and by inventory group Cost NRV LCNRV applied to Per Unit Total for Product Per Unit Total for Quantity Items product Group product Red Unscented Candles 29 5.80 5.60 Purple Unscented Candles 13 5.80 6.05 Red Sand Candles 15 10 9.70 Blue Sand Candles 12 5.90 5.20 Red Scented Candles 16 8.15 7.80 Totals b) Prepare any required adjusting entry assuming LCNRV is applied to each item. Dates must be entered in the format dd/mmm (15/Jan). Leave the entry blank if no adjusting entry is required General Journal Account/Explanation Page GJ8 Credit Date F Debit c) Prepare any required adjusting entry assuming LCNRV is applied to the whole group Dates must be entered in the format dd/mmm (15/Jan). Leave the entry blank if no adjusting entry is required General Journal Page GJS Account Explanation F Debit Credit Date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts