Question: Question 2 20 points Save Answer As a financial analyst at Lotus Financial, you are applying a single factor APT model to analyze an arbitrage

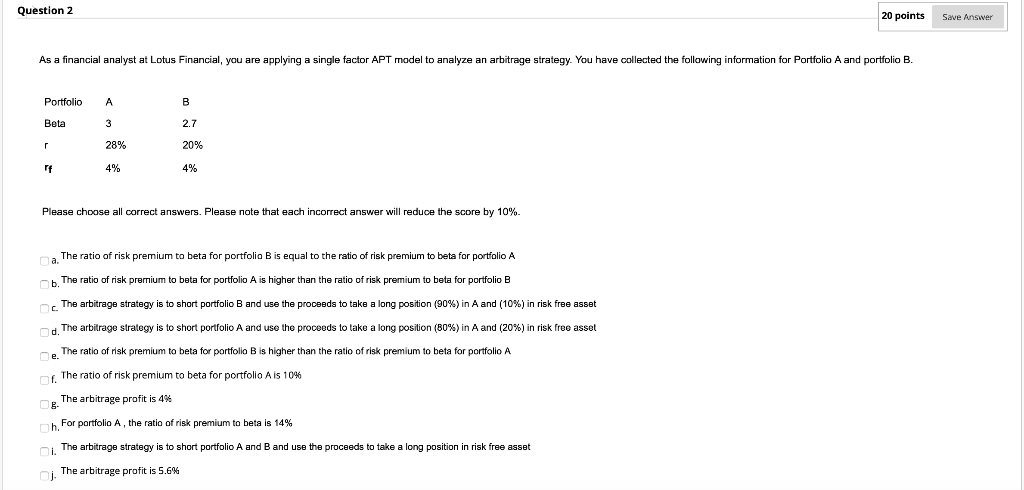

Question 2 20 points Save Answer As a financial analyst at Lotus Financial, you are applying a single factor APT model to analyze an arbitrage strategy. You have collected the following information for Portfolio A and portfolio B. Portfolio A B Beta 3 2.7 r 28% 20% 4% 4% Please choose all correct answers. Please note that each incorrect answer will reduce the score by 10%. a The ratio of risk premium to beta for portfolio B is equal to the ratio of risk premium to beta for portfolio A b. The ratio of risk premium to beta for portfolio A is higher than the ratio of risk premium to beta for portfolio B The arbitrage strategy is to short portfolio B and use the proceed to take a long position (90%) in A and (10%) in risk free asset The arbitrage strategy is to short portfolio A and use the proceeds to take a long position (80%) in A and (20%) in risk free asset The ratio of risk premium to beta for portfolio B is higher than the ratio of risk premium to beta for portfolio A f. The ratio of risk premium to beta for portfolio A is 10% The arbitrage profit is 49 h. For portfolio A, the ratio of risk premium to beta is 14% i. The arbitrage strategy is to short portfolio A and B and use the proceeds to take a long position in risk free asset The arbitrage profit is 5.6% Question 2 20 points Save Answer As a financial analyst at Lotus Financial, you are applying a single factor APT model to analyze an arbitrage strategy. You have collected the following information for Portfolio A and portfolio B. Portfolio A B Beta 3 2.7 r 28% 20% 4% 4% Please choose all correct answers. Please note that each incorrect answer will reduce the score by 10%. a The ratio of risk premium to beta for portfolio B is equal to the ratio of risk premium to beta for portfolio A b. The ratio of risk premium to beta for portfolio A is higher than the ratio of risk premium to beta for portfolio B The arbitrage strategy is to short portfolio B and use the proceed to take a long position (90%) in A and (10%) in risk free asset The arbitrage strategy is to short portfolio A and use the proceeds to take a long position (80%) in A and (20%) in risk free asset The ratio of risk premium to beta for portfolio B is higher than the ratio of risk premium to beta for portfolio A f. The ratio of risk premium to beta for portfolio A is 10% The arbitrage profit is 49 h. For portfolio A, the ratio of risk premium to beta is 14% i. The arbitrage strategy is to short portfolio A and B and use the proceeds to take a long position in risk free asset The arbitrage profit is 5.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts