Question: Question 2 (20 Points): You have now been asked to estimate the Free Cash Flow to Equity for Environ and have collected the following information

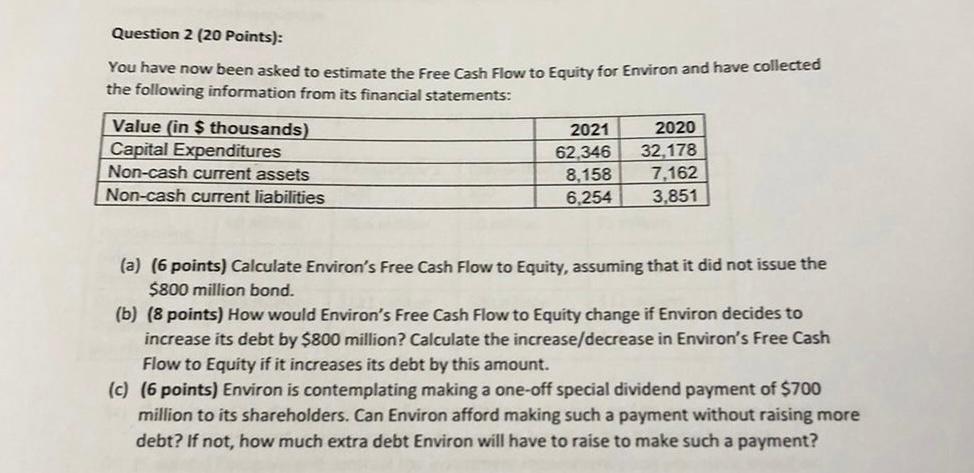

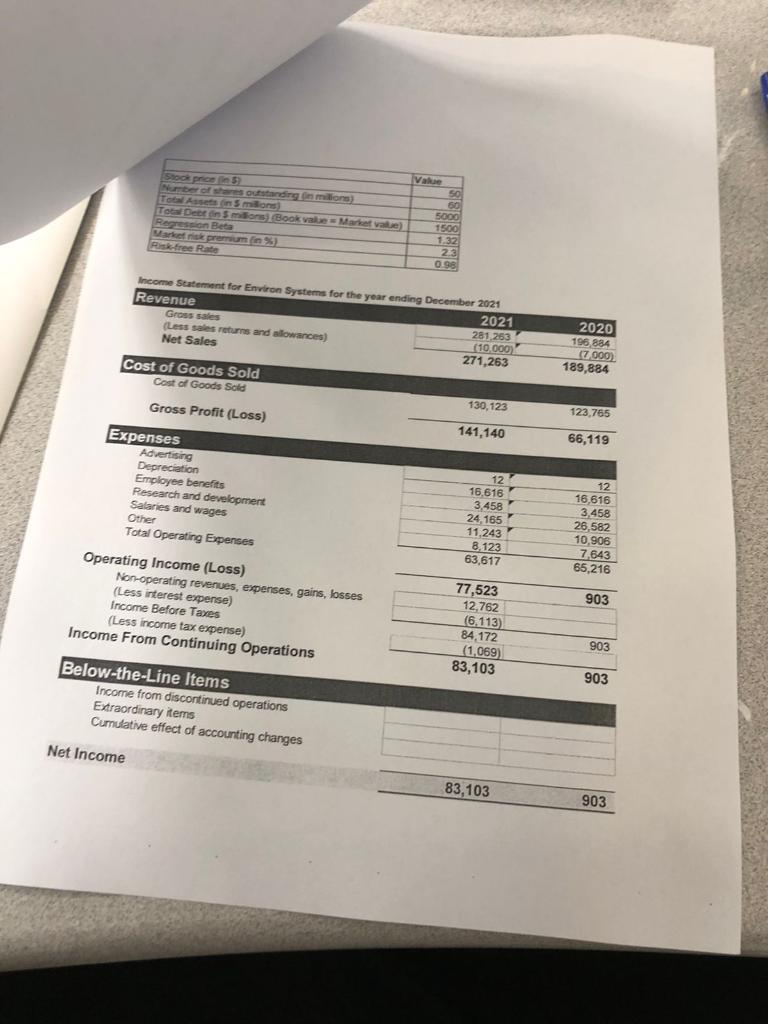

Question 2 (20 Points): You have now been asked to estimate the Free Cash Flow to Equity for Environ and have collected the following information from its financial statements: Value (in $ thousands) Capital Expenditures 62,346 32,178 Non-cash current assets 8,158 7,162 Non-cash current liabilities 6,254 2021 2020 3,851 (a) (6 points) Calculate Environ's Free Cash Flow to Equity, assuming that it did not issue the $800 million bond. (b) (8 points) How would Environ's Free Cash Flow to Equity change if Environ decides to increase its debt by $800 million? Calculate the increase/decrease in Environ's Free Cash Flow to Equity if it increases its debt by this amount. (c) (6 points) Environ is contemplating making a one-off special dividend payment of $700 million to its shareholders. Can Environ afford making such a payment without raising more debt? If not, how much extra debt Environ will have to raise to make such a payment? Vale Stoopro 50 Nuoro shares onding in millions To Assin 5 mins 5000 Tot Deen millions Book valueMarket value) 1500 Regression Bete 1.32 Market nok premium in 23 Pisk-free Rate 0.98 Income Statement for Environ Systems for the year ending December 2021 Revenue 2021 Gross sales 281, 263 (Less sales returns and allowances) (10.000 Net Sales 271,263 2020 196 884 (7000) 189,884 Cost of Goods Sold Cost of Goods Sold Gross Profit (Loss) 130,123 123,765 141,140 66,119 Expenses Advertising Depreciation Employee benefits Research and development Salaries and wages Other Total Operating Expenses Operating Income (Loss) Non-operating revenues, expenses, gains, losses (Less interest expense) Income Before Taves (Less income tax expense) Income From Continuing Operations 12 16.616 3,458 24.165 11,243 8,123 63.617 12 16,616 3,458 26,582 10,906 7,643 65,216 903 77,523 12,762 (6.113) 84,172 (1,069) 83,103 903 903 Below-the-Line Items Income from discontinued operations Extraordinary items Cumulative effect of accounting changes Net Income 83,103 903 Question 2 (20 Points): You have now been asked to estimate the Free Cash Flow to Equity for Environ and have collected the following information from its financial statements: Value (in $ thousands) Capital Expenditures 62,346 32,178 Non-cash current assets 8,158 7,162 Non-cash current liabilities 6,254 2021 2020 3,851 (a) (6 points) Calculate Environ's Free Cash Flow to Equity, assuming that it did not issue the $800 million bond. (b) (8 points) How would Environ's Free Cash Flow to Equity change if Environ decides to increase its debt by $800 million? Calculate the increase/decrease in Environ's Free Cash Flow to Equity if it increases its debt by this amount. (c) (6 points) Environ is contemplating making a one-off special dividend payment of $700 million to its shareholders. Can Environ afford making such a payment without raising more debt? If not, how much extra debt Environ will have to raise to make such a payment? Vale Stoopro 50 Nuoro shares onding in millions To Assin 5 mins 5000 Tot Deen millions Book valueMarket value) 1500 Regression Bete 1.32 Market nok premium in 23 Pisk-free Rate 0.98 Income Statement for Environ Systems for the year ending December 2021 Revenue 2021 Gross sales 281, 263 (Less sales returns and allowances) (10.000 Net Sales 271,263 2020 196 884 (7000) 189,884 Cost of Goods Sold Cost of Goods Sold Gross Profit (Loss) 130,123 123,765 141,140 66,119 Expenses Advertising Depreciation Employee benefits Research and development Salaries and wages Other Total Operating Expenses Operating Income (Loss) Non-operating revenues, expenses, gains, losses (Less interest expense) Income Before Taves (Less income tax expense) Income From Continuing Operations 12 16.616 3,458 24.165 11,243 8,123 63.617 12 16,616 3,458 26,582 10,906 7,643 65,216 903 77,523 12,762 (6.113) 84,172 (1,069) 83,103 903 903 Below-the-Line Items Income from discontinued operations Extraordinary items Cumulative effect of accounting changes Net Income 83,103 903

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts