Question: Question 2 20 pts NPV - part 1 This question (final answer) AND the next question (multi-part intermediate questions relate to the following information. Hint:

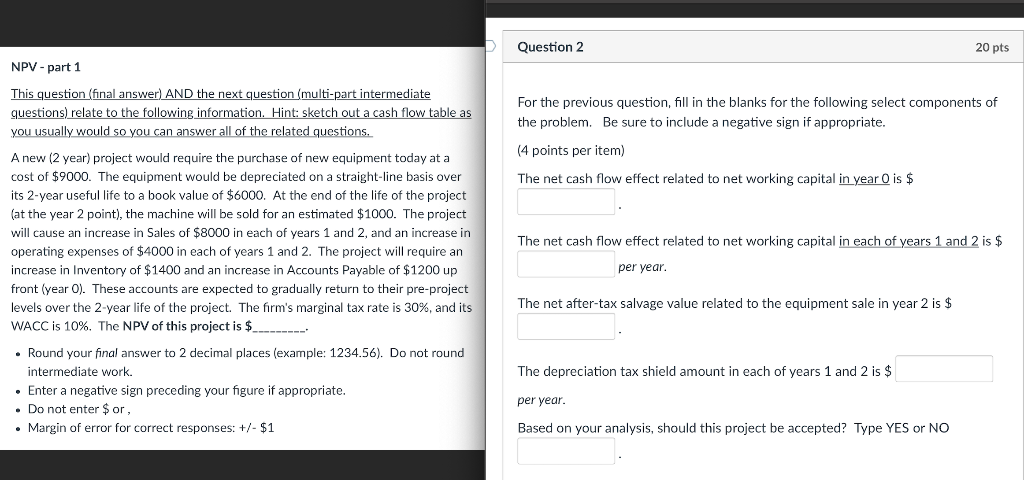

Question 2 20 pts NPV - part 1 This question (final answer) AND the next question (multi-part intermediate questions relate to the following information. Hint: sketch out a cash flow table as you usually would so you can answer all of the related questions. For the previous question, fill in the blanks for the following select components of the problem. Be sure to include a negative sign if appropriate. (4 points per item) The net cash flow effect related to net working capital in year O is $ The net cash flow effect related to net working capital in each of years 1 and 2 is $ per year. A new (2 year) project would require the purchase of new equipment today at a cost of $9000. The equipment would be depreciated on a straight-line basis over its 2-year useful life to a book value of $6000. At the end of the life of the project (at the year 2 point), the machine will be sold for an estimated $1000. The project will cause an increase in Sales of $8000 in each of years 1 and 2, and an increase in operating expenses of $4000 in each of years 1 and 2. The project will require an increase in Inventory of $1400 and an increase in Accounts Payable of $1200 up front (Year O). These accounts are expected to gradually return to their pre-project levels over the 2-year life of the project. The firm's marginal tax rate is 30%, and its WACC is 10%. The NPV of this project is $ Round your final answer to 2 decimal places (example: 1234.56). Do not round intermediate work. Enter a negative sign preceding your figure if appropriate. . Do not enter $or, Margin of error for correct responses: +/- $1 The net after-tax salvage value related to the equipment sale in year 2 is $ The depreciation tax shield amount in each of years 1 and 2 is $ per year. Based on your analysis, should this project be accepted? Type YES or NO Question 2 20 pts NPV - part 1 This question (final answer) AND the next question (multi-part intermediate questions relate to the following information. Hint: sketch out a cash flow table as you usually would so you can answer all of the related questions. For the previous question, fill in the blanks for the following select components of the problem. Be sure to include a negative sign if appropriate. (4 points per item) The net cash flow effect related to net working capital in year O is $ The net cash flow effect related to net working capital in each of years 1 and 2 is $ per year. A new (2 year) project would require the purchase of new equipment today at a cost of $9000. The equipment would be depreciated on a straight-line basis over its 2-year useful life to a book value of $6000. At the end of the life of the project (at the year 2 point), the machine will be sold for an estimated $1000. The project will cause an increase in Sales of $8000 in each of years 1 and 2, and an increase in operating expenses of $4000 in each of years 1 and 2. The project will require an increase in Inventory of $1400 and an increase in Accounts Payable of $1200 up front (Year O). These accounts are expected to gradually return to their pre-project levels over the 2-year life of the project. The firm's marginal tax rate is 30%, and its WACC is 10%. The NPV of this project is $ Round your final answer to 2 decimal places (example: 1234.56). Do not round intermediate work. Enter a negative sign preceding your figure if appropriate. . Do not enter $or, Margin of error for correct responses: +/- $1 The net after-tax salvage value related to the equipment sale in year 2 is $ The depreciation tax shield amount in each of years 1 and 2 is $ per year. Based on your analysis, should this project be accepted? Type YES or NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts