Question: Question 2 2.1 Describe how net present value (NPV) is calculated and describe the information this measure provides about a sequence of cash flows. What

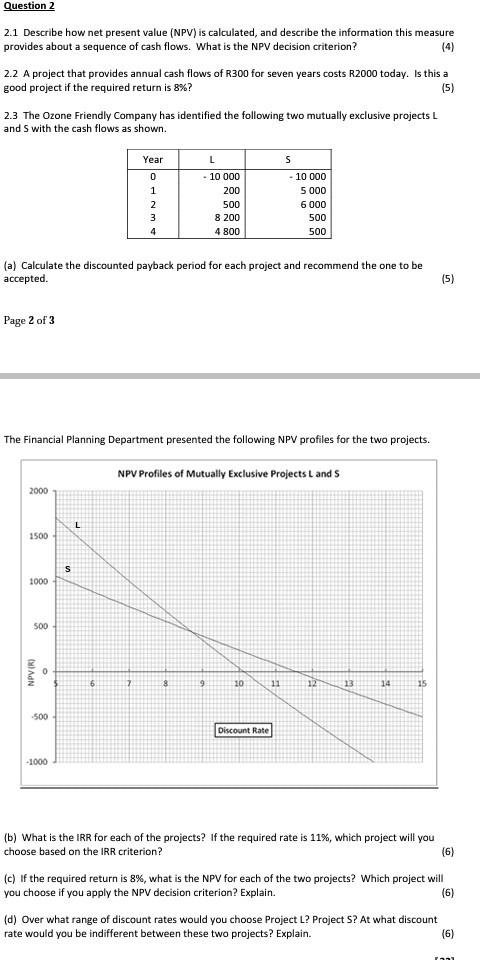

Question 2 2.1 Describe how net present value (NPV) is calculated and describe the information this measure provides about a sequence of cash flows. What is the NPV decision criterion? (4) 2.2 A project that provides annual cash flows of R300 for seven years costs R2000 today. Is this a good project if the required return is 8%? (5) 2.3 The Ozone Friendly Company has identified the following two mutually exclusive projects L and S with the cash flows as shown. Year 0 1 10 000 200 500 8 200 4 800 s - 10 000 5 000 6 000 500 500 WN 4 (a) Calculate the discounted payback period for each project and recommend the one to be accepted. (5) Page 2 of 3 The Financial Planning Department presented the following NPV profiles for the two projects. NPV Profiles of Mutually Exclusive Projects and S 2000 L 1500 s 1000 500 NPVR 0 6 10 11 12 13 14 15 -500 Discount Rate -1000 (b) What is the IRR for each of the projects? If the required rate is 11%, which project will you choose based on the IRR criterion? (6) (c) If the required return is 8%, what is the NPV for each of the two projects? Which project will you choose if you apply the NPV decision criterion? Explain. (6) (d) Over what range of discount rates would you choose Project L? Project S? At what discount rate would you be indifferent between these two projects? Explain. (6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts