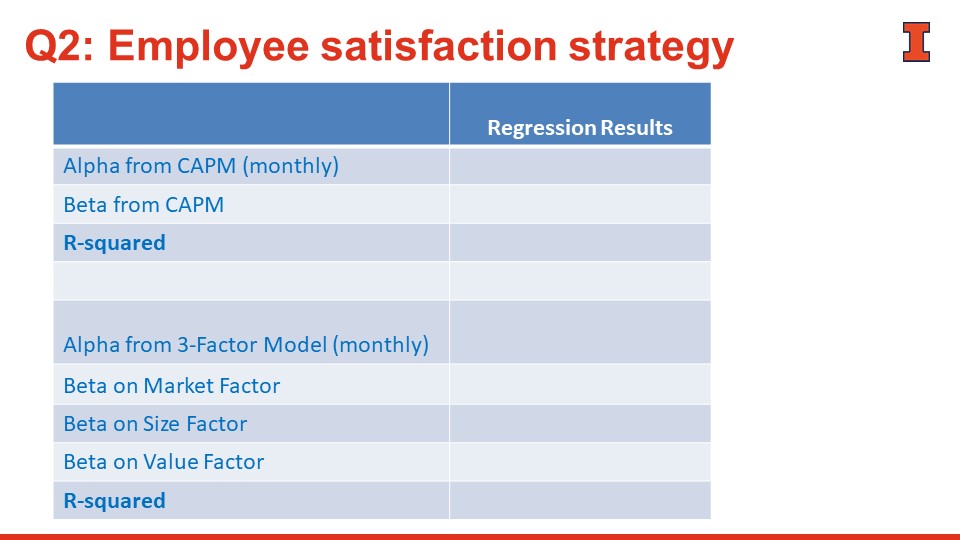

Question: Question 2 (24 points) I Using the spreadsheet, Employee_Satisfaction_Returns.xlsx, analyze the strategy of investing equally in all the publicly-traded members of the Fortune list released

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts