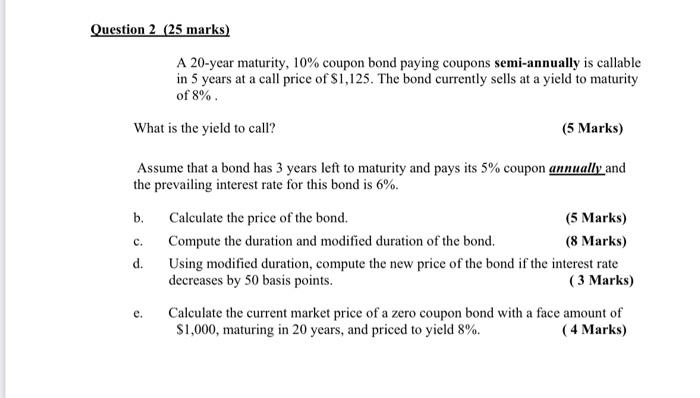

Question: Question 2 (25 marks) A 20-year maturity, 10% coupon bond paying coupons semi-annually is callable in 5 years at a call price of $1,125. The

Question 2 (25 marks) A 20-year maturity, 10% coupon bond paying coupons semi-annually is callable in 5 years at a call price of $1,125. The bond currently sells at a yield to maturity of 8% What is the yield to call? (5 Marks) C. Assume that a bond has 3 years left to maturity and pays its 5% coupon annually and the prevailing interest rate for this bond is 6%. b. Calculate the price of the bond. (5 Marks) Compute the duration and modified duration of the bond. (8 Marks) d. Using modified duration, compute the new price of the bond if the interest rate decreases by 50 basis points. (3 Marks) Calculate the current market price of a zero coupon bond with a face amount of $1,000, maturing in 20 years, and priced to yield 8%. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts