Question: Question 2 (25 marks) a) Given that the Australian dollar's spot rate is USS0.9000 and that the Australian and US one year interest rates are

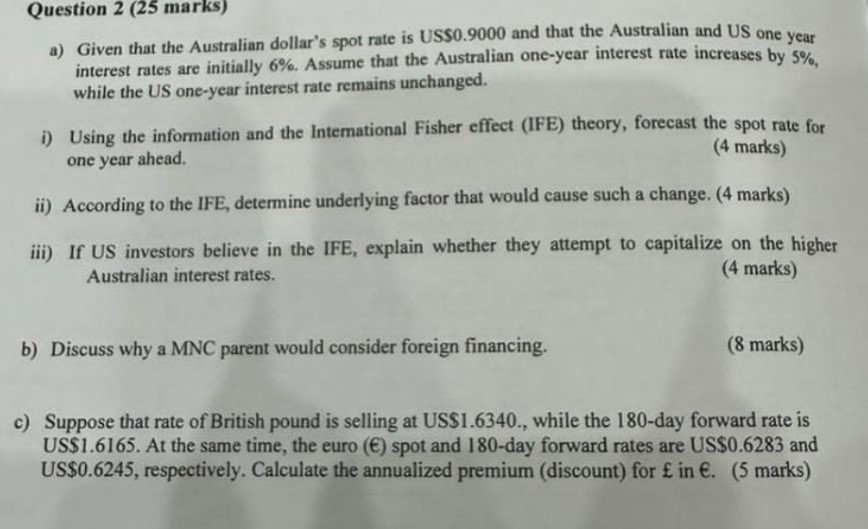

Question 2 (25 marks) a) Given that the Australian dollar's spot rate is USS0.9000 and that the Australian and US one year interest rates are initially 6%. Assume that the Australian one-year interest rate increases by 5%, while the US one-year interest rate remains unchanged. i) Using the information and the Intemational Fisher effect (IFE) theory, forecast the spot rate for one year ahead. (4 marks) ii) According to the IFE, determine underlying factor that would cause such a change. (4 marks) iii) If US investors believe in the IFE, explain whether they attempt to capitalize on the higher Australian interest rates. (4 marks) b) Discuss why a MNC parent would consider foreign financing. (8 marks) c) Suppose that rate of British pound is selling at US\$1.6340., while the 180-day forward rate is US\$1.6165. At the same time, the euro () spot and 180-day forward rates are US\$0.6283 and US\$0.6245, respectively. Calculate the annualized premium (discount) for in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts