Question: QUESTION 2 (25 Marks) (a) What should be the features of an automobile company's capital structure? Use your imagination and justify your answer with appropriate

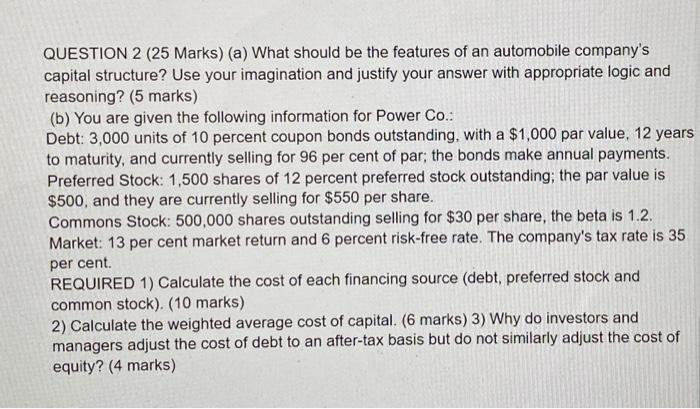

QUESTION 2 (25 Marks) (a) What should be the features of an automobile company's capital structure? Use your imagination and justify your answer with appropriate logic and reasoning? (5 marks) (b) You are given the following information for Power Co.: Debt: 3,000 units of 10 percent coupon bonds outstanding, with a $1,000 par value, 12 years to maturity, and currently selling for 96 per cent of par; the bonds make annual payments. Preferred Stock: 1,500 shares of 12 percent preferred stock outstanding; the par value is $500, and they are currently selling for $550 per share. Commons Stock: 500,000 shares outstanding selling for $30 per share, the beta is 1.2. Market: 13 per cent market return and 6 percent risk-free rate. The company's tax rate is 35 per cent. REQUIRED 1) Calculate the cost of each financing source (debt, preferred stock and common stock). (10 marks) 2) Calculate the weighted average cost of capital. (6 marks) 3) Why do investors and managers adjust the cost of debt to an after-tax basis but do not similarly adjust the cost of equity? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts