Question: QUESTION 2 (25 marks) Grey Stone Limited is a construction company with a 15% interest in Bold Bricks Limited, a building material supplier. The

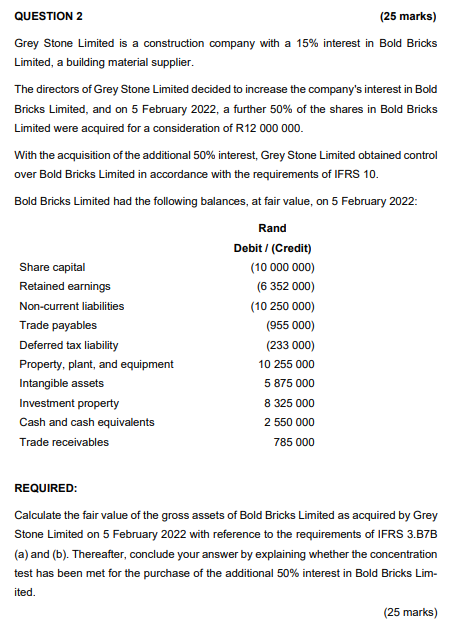

QUESTION 2 (25 marks) Grey Stone Limited is a construction company with a 15% interest in Bold Bricks Limited, a building material supplier. The directors of Grey Stone Limited decided to increase the company's interest in Bold Bricks Limited, and on 5 February 2022, a further 50% of the shares in Bold Bricks Limited were acquired for a consideration of R12 000 000. With the acquisition of the additional 50% interest, Grey Stone Limited obtained control over Bold Bricks Limited in accordance with the requirements of IFRS 10. Bold Bricks Limited had the following balances, at fair value, on 5 February 2022: Rand Debit / (Credit) Share capital (10 000 000) Retained earnings Non-current liabilities Trade payables Deferred tax liability Property, plant, and equipment Intangible assets Investment property Cash and cash equivalents Trade receivables (6 352 000) (10 250 000) (955 000) (233 000) 10 255 000 5 875 000 8 325 000 2 550 000 785 000 REQUIRED: Calculate the fair value of the gross assets of Bold Bricks Limited as acquired by Grey Stone Limited on 5 February 2022 with reference to the requirements of IFRS 3.B7B (a) and (b). Thereafter, conclude your answer by explaining whether the concentration test has been met for the purchase of the additional 50% interest in Bold Bricks Lim- ited. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts