Question: Question 2 (25 marks) Mega Valuc's main product is the sugar lollipop. Each item is sold for $800 with a profit margin of 25% each.

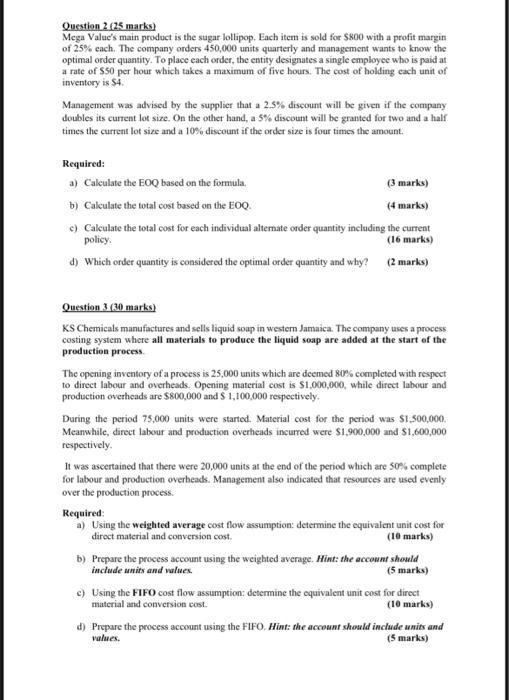

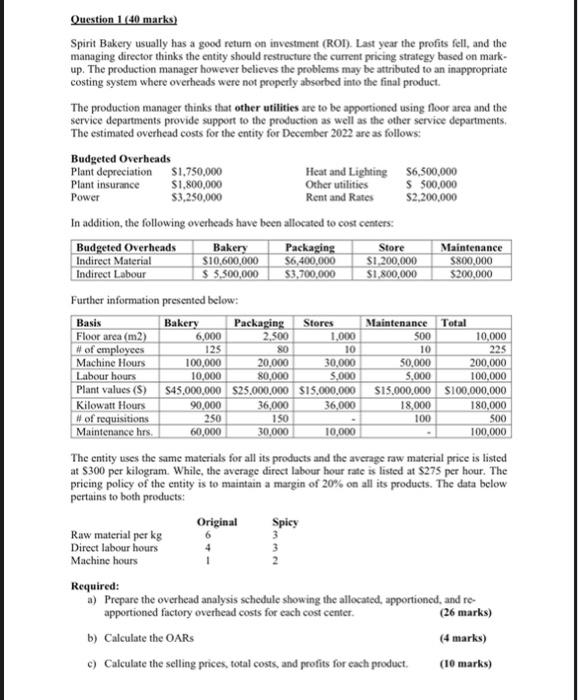

Question 2 (25 marks) Mega Valuc's main product is the sugar lollipop. Each item is sold for $800 with a profit margin of 25% each. The company orders 450,000 units quarterly and management wants to know the optimal order quantity. To place each order, the entity designates a single employee who is paid at a rate of $50 per hour which takes a maximum of five hours. The cost of holding each unit of inventory is $4. Management was advised by the supplier that a 2.5% diseount will be given if the cormpany doubles its current lot size. On the other hand, a 5% discount will be granted for two and a half times the current lot size and a 10% discount if the order size is four times the amount. Required: a) Calculate the EOQ based on the formula, (3 marks) b) Calculate the total cost based on the EOQ. (4 marks) c) Calculate the total cost for each individual alternate order quantity including the current policy. (16 marks) d) Which order quantity is considered the optimal order quantity and why? (2 marks) Question 3 (30 marks) KS Chemicals manufactures and sells liquid soap in westem Jamaica. The company uses a process costing system where all materials to produce the liquid soap are added at the start of the production process. The opening inventory of a process is 25,000 units which are deemed 80% completed with respect to direct labour and overheads. Opening material cost is 51,000,000, while direct labour and production overheads are $800,000 and $1,100,000 respectively. During the period 75,000 units were started. Material cost for the period was $1,500,000. Meanwhile, direct labcur and production overheads incurred were $1,900,000 and $1,600,000 respectively. It was ascertained that there were 20,000 units at the end of the period which are 50 fo complete for labour and production overbeads. Management also indicated that resources are used evenly over the production process. Required: a) Using the weighted average cost flow assumption: determine the equivalent unit cost for direct material and conversion cost. (10 marks) b) Prepare the process account using the weighted average. Hint the account sheuld include units and vilues. (5 marks) c) Using the FIFO cost flow assumption: determine the equivalent unit cost for direct material and conversion cost. (10 marks) d) Prepare the process account using the FIFO. Hint: the account should include units and vulues. (5 marks) Question 1 (40 marks) Spirit Bakery usually has a good return on investment (ROI). Last year the profits fell, and the managing director thinks the entity should restructure the current pricing strategy based on markup. The production manager however believes the problems may be attributed to an inappropriate costing system where overheads were not properly absorbed into the final product. The production manager thinks that other utilities are to be apportioned using floor area and the service departments provide support to the production as well as the other service departments. The estimated overhead costs for the entity for December 2022 are as follows: In addition, the following overheads have been allocated to cost centers: Further information presented below: The entity uses the same materials for all its products and the average raw material price is listed at $300 per kilogram. While, the average direct labour hour rate is listed at $275 per hour. The pricing policy of the entity is to maintain a margin of 20% on all its products. The data below pertains to both products: Required: a) Prepare the overhead analysis schedule showing the allocated, apportioned, and reapportioned factory overhead costs for each cost center. (26 marks) b) Calculate the OARs (4 marks) c) Calculate the selling prices, total costx, and profits for each product. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts