Question: Question 2 (25 points) A real estate development company is planning to construct a stadium building. The estimated construction cost is $20 million. The owner

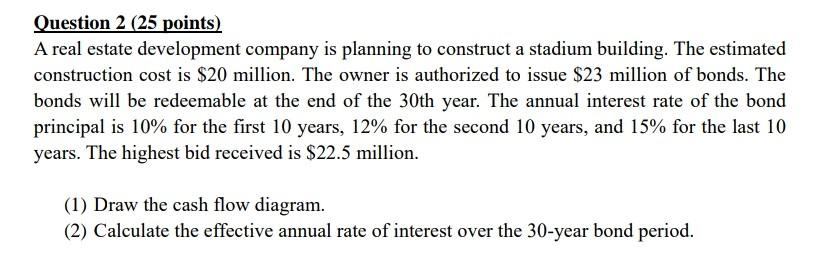

Question 2 (25 points) A real estate development company is planning to construct a stadium building. The estimated construction cost is $20 million. The owner is authorized to issue $23 million of bonds. The bonds will be redeemable at the end of the 30 th year. The annual interest rate of the bond principal is 10% for the first 10 years, 12% for the second 10 years, and 15% for the last 10 years. The highest bid received is $22.5 million. (1) Draw the cash flow diagram. (2) Calculate the effective annual rate of interest over the 30 -year bond period. Question 2 (25 points) A real estate development company is planning to construct a stadium building. The estimated construction cost is $20 million. The owner is authorized to issue $23 million of bonds. The bonds will be redeemable at the end of the 30 th year. The annual interest rate of the bond principal is 10% for the first 10 years, 12% for the second 10 years, and 15% for the last 10 years. The highest bid received is $22.5 million. (1) Draw the cash flow diagram. (2) Calculate the effective annual rate of interest over the 30 -year bond period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts