Question: Question 2 (2.5 points) Clinevo, Inc. is considering a new project that will cost $1,680,000 today. The project is expected to generate annual operating net

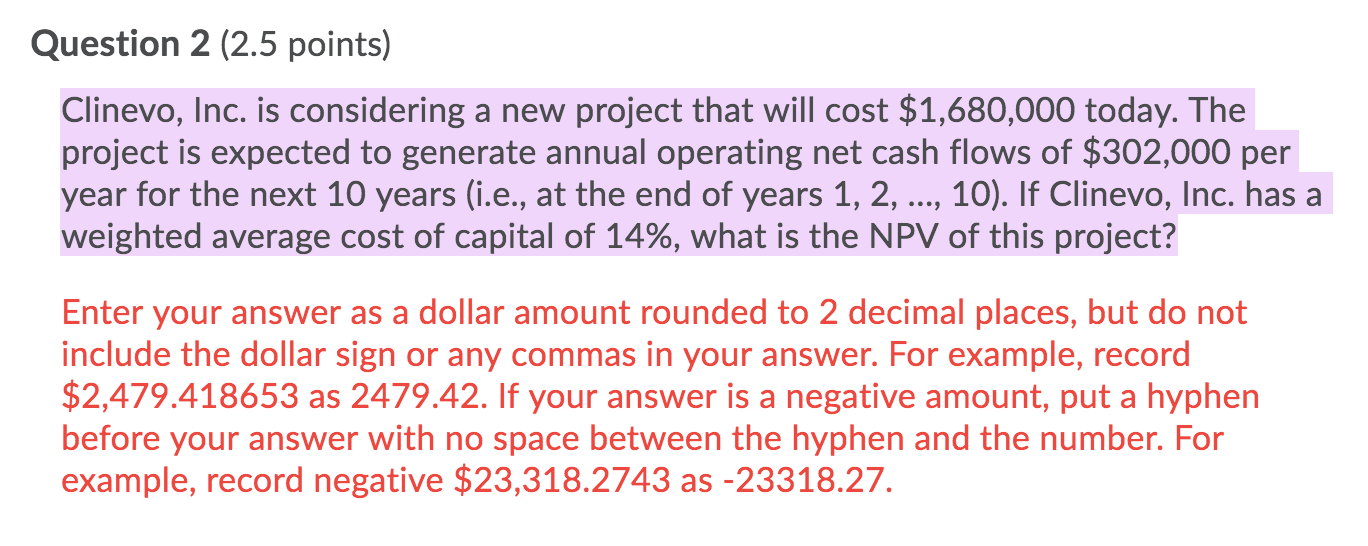

Question 2 (2.5 points) Clinevo, Inc. is considering a new project that will cost $1,680,000 today. The project is expected to generate annual operating net cash flows of $302,000 per year for the next 10 years (i.e., at the end of years 1, 2, ..., 10). If Clinevo, Inc. has a weighted average cost of capital of 14%, what is the NPV of this project? Enter your answer as a dollar amount rounded to 2 decimal places, but do not include the dollar sign or any commas in your answer. For example, record $2,479.418653 as 2479.42. If your answer is a negative amount, put a hyphen before your answer with no space between the hyphen and the number. For example, record negative $23,318.2743 as -23318.27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts